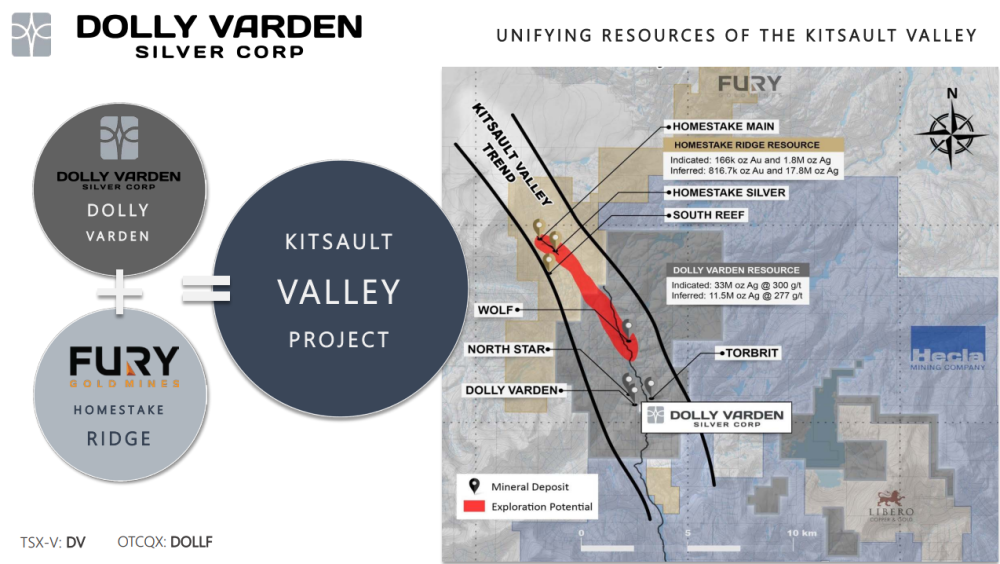

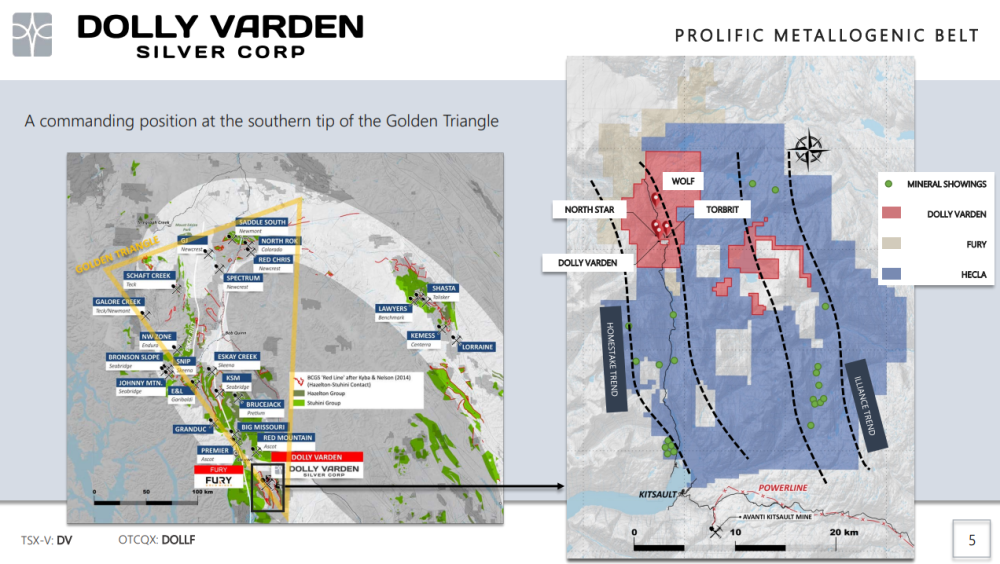

Maurice: Joining us for a conversation is Shawn Khunkhun, the CEO of Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX). It's a great time to be speaking with you as Dolly Varden Silver has just expanded its footprint in the highly prospective Kitsault Valley trend located in the prolific Golden Triangle of British Columbia. Before we begin, Mr. Khunkhun, please introduce us to Dolly Varden Silver and the opportunity the company presents to shareholders.

Shawn Khunkhun: Dolly Varden has just announced today that we are set to acquire Homestake Ridge from Fury. Up until this moment, Dolly Varden was a silver-focused company in the Golden Triangle with a mineral endowment of 44 million ounces of high-grade silver. What today's announcement proposes, is Dolly Varden is going to have a shareholder vote. We've got support from one our larger shareholders, Eric Sprott, who has not only publicly given his support, but he's actually signed up support and lockup agreements for this transaction.

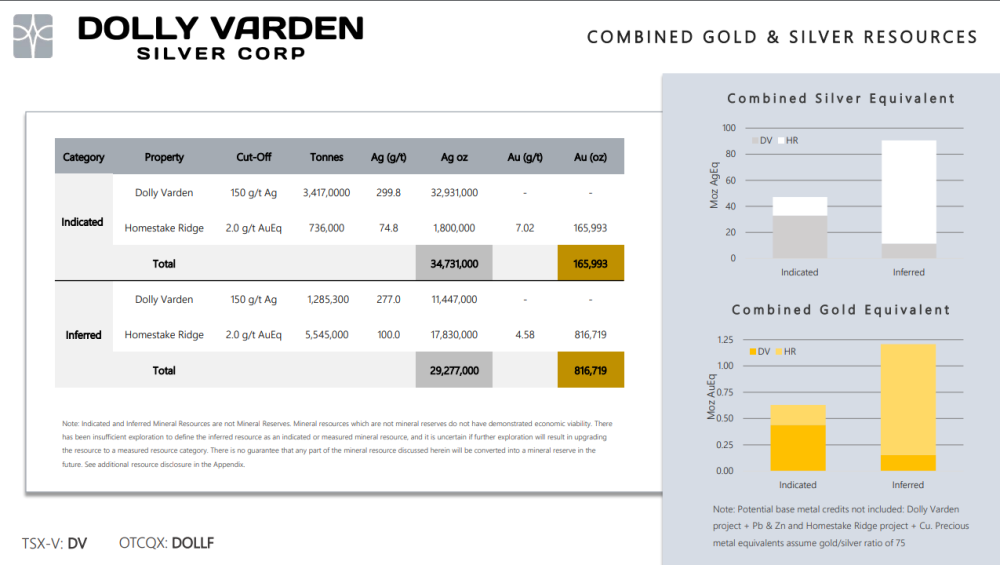

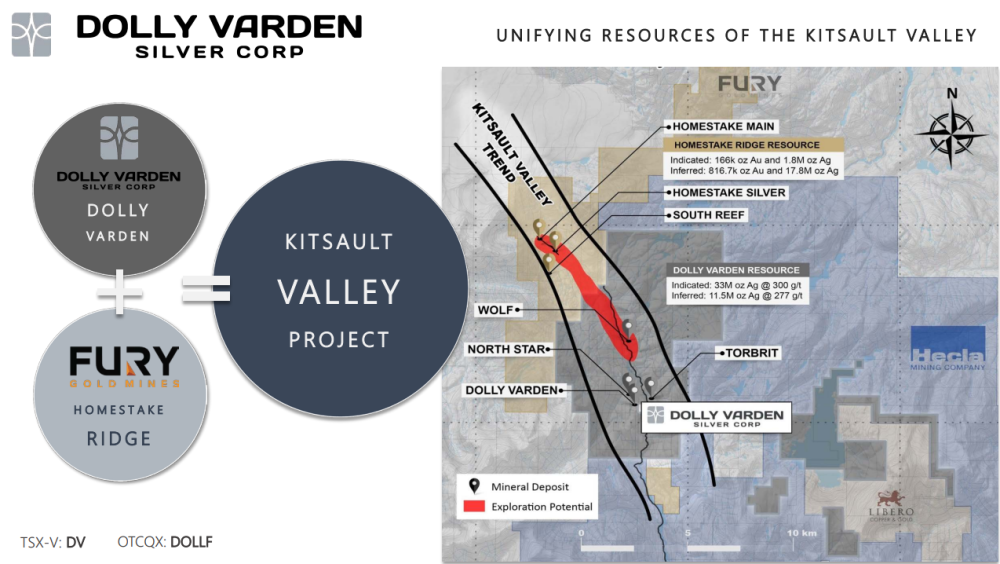

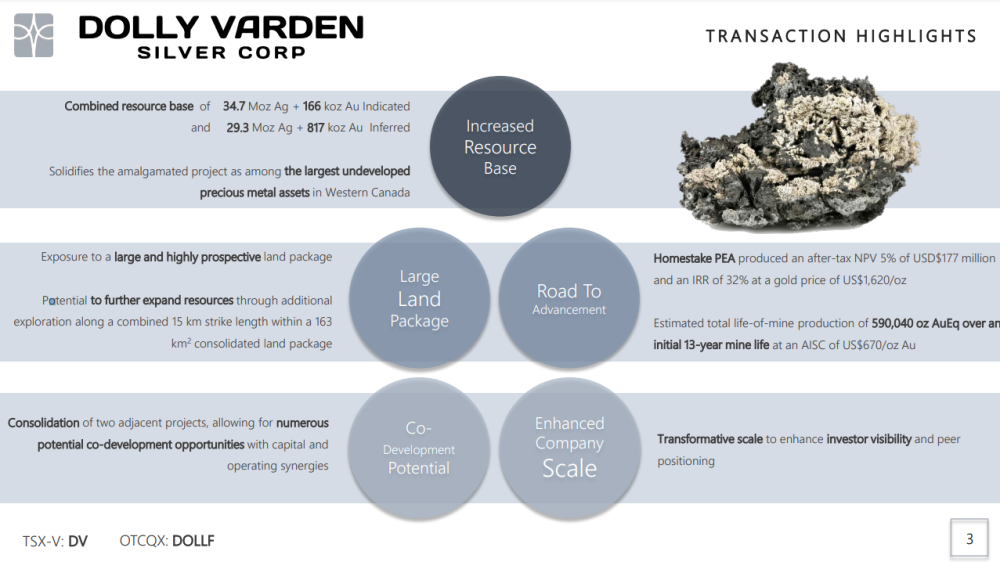

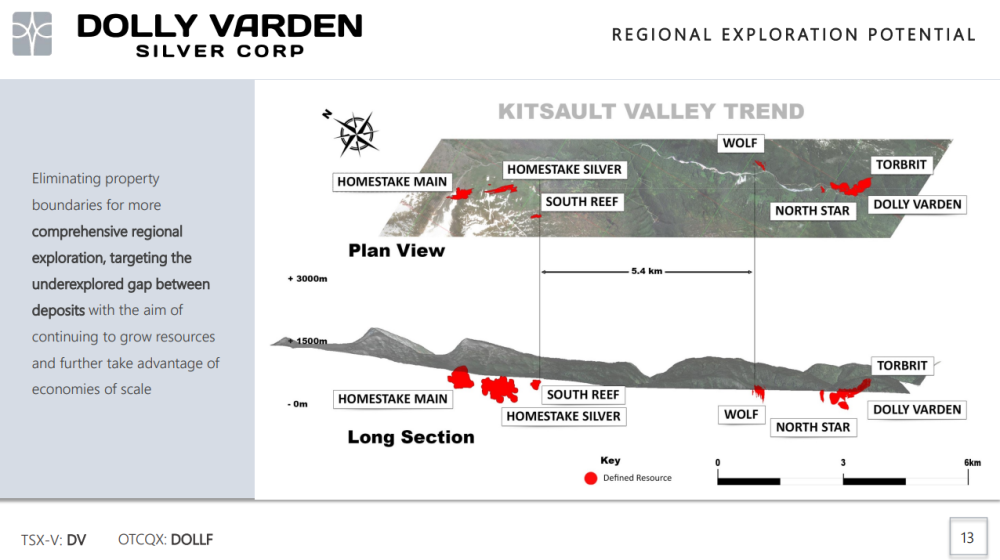

We are looking to unify the Kitsault Valley trend, which is comprised of seven known deposits along 15 kilometers of Hazleton Rocks in the Golden Triangle, of which four of these deposits are on the Dolly Varden side and three are on the Homestake Ridge side. The amalgamation would also dramatically increase our mineral inventory taking us from 44 million ounces of high-grade silver to 137 million ounces of high-grade silver equivalent. To look at it through a gold lens, we would be at over 1.8 million ounces of high-grade gold.

We are looking to unify the Kitsault Valley trend, which is comprised of seven known deposits along 15 kilometers of Hazleton Rocks in the Golden Triangle, of which four of these deposits are on the Dolly Varden side and three are on the Homestake Ridge side. The amalgamation would also dramatically increase our mineral inventory taking us from 44 million ounces of high-grade silver to 137 million ounces of high-grade silver equivalent. To look at it through a gold lens, we would be at over 1.8 million ounces of high-grade gold.

Maurice: Now before we get into the details of the transaction, please acquaint us with the Homestake Ridge Project, which hosts a resource in the inferred and indicated category of both gold and silver, along with a PEA.

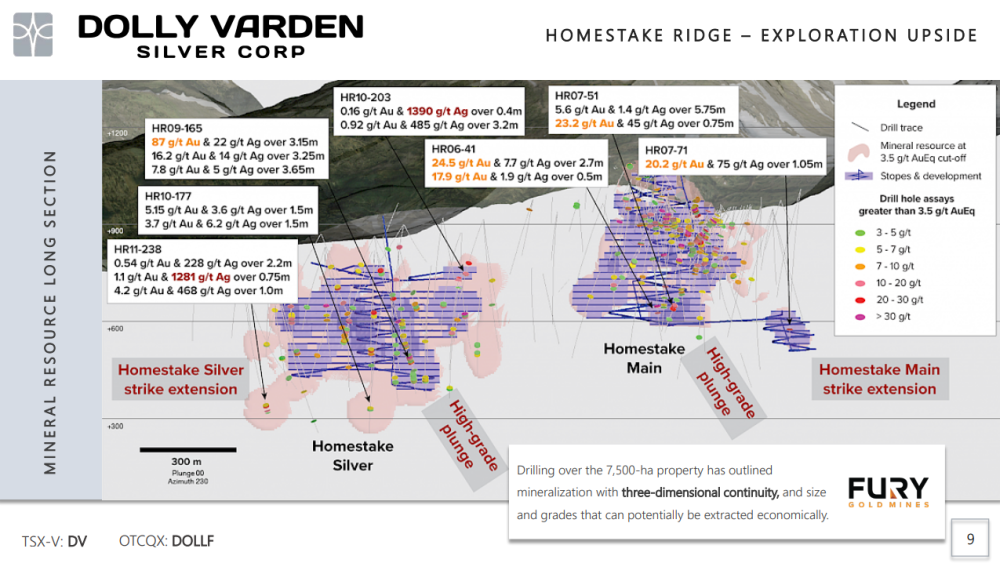

Shawn Khunkhun: Homestake Ridge, looking at it based on their gold ounces, has about 900,000 ounces of gold, about 18 million ounces silver, or one could look at it through a gold lens of 1.2 million ounces gold equivalent or 93 million ounces silver equivalent. It's a project that is situated in the Golden Triangle. It's a project that is open at depth and along strike. And it's a project that hosts some very, very impressive grades.

And some of the opportunities at Homestake Ridge are there are some high-grade areas that not only do you have 20, 30 gram per ton gold material, but you have it over wide intervals. There are some tremendous opportunities to take some of the inferred resources and move them along into the indicated category. But you're probably going to have some big surprises there in that just as Dolly Varden saw last year at our Torbrit Mine, which is a silver-rich mine, there is a tremendous opportunity when you vector into the high-grade.

For example, our resource on our side of the property is 300-gram silver. We did some infill drilling last year and we were finding that the resources were understated, as we were finding 450 gram material over big wide intervals. I suspect those same opportunities are going to persist on the Homestake side of the trend.

But the real story here, is that there are 5.5 kilometers in between the two projects that have never been explored. And both companies independently had done some geophysical work that has both concluded in three large geophysical anomalies in between, so I suspect we'll move from seven deposits potentially to 10 and counting. We feel confident that there's a huge, huge exploration upside before us.

I came into Dolly Varden in February 2020. This was a company that had $3 million in the bank. It had 44 million ounces in the ground and it had a $20 million market cap. Post this transaction, this is a $125 million company with 140 million ounces of silver equivalent in the ground, boasting an impressive treasury and with an experienced technical team that will continue to unlock discovery opportunities.

Maurice: Now I have to ask you, sir, how were you able to acquire the Homestake Ridge? Could you walk us through the details of the transaction?

Shawn Khunkhun: I think it was just one of these situations where when an M&A deal works for both parties, it's the best. I really believe in business, how do you create win-win-win opportunities, whether it's with our first nations partners, the Nisga'a, where we bring employment opportunities and they give us social license to do our exploration work.

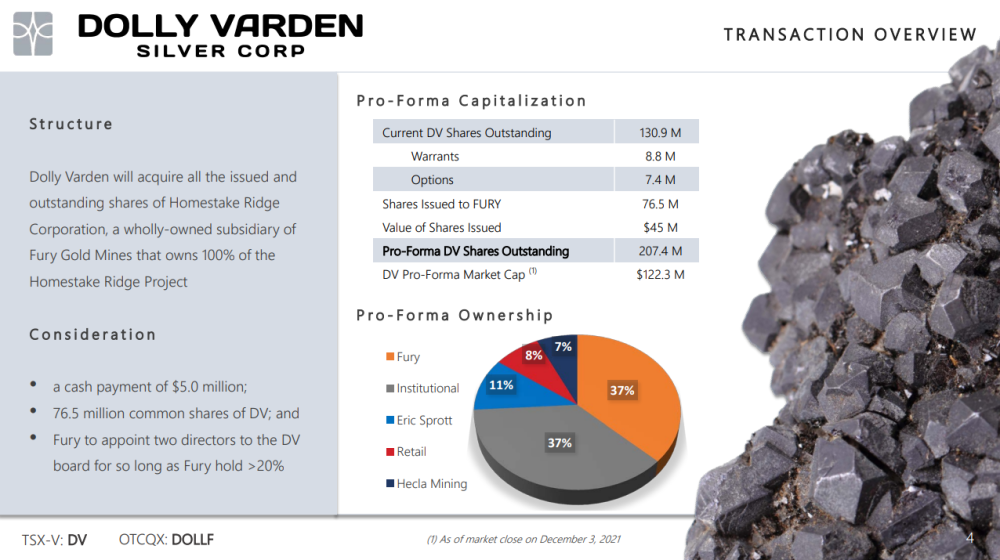

Or whether it's in the case of this M&A transaction where Fury is undervalued based on the incredible mineral endowment they have. And they've got three great projects in Canada, but the challenge with three great projects is how do you advance them all? Therefore, what Fury Gold Mines will be doing is they're partnering with us. Ivan Bebek, Fury's chairman, wants to ride the upside in Dolly Varden stock. So we structured a deal where we allowed him to ride the upside by becoming a 37% shareholder.

Now that's a lot of trust to place in an outside party. They signed escrow agreements so that their stock is held up longer than the traditional hold periods. And there are all sorts of other parts of the investor rights agreement that are quite favorable for Dolly Varden shareholders, but they're able to ride in the upside. As this project gets re-rated because it's now got scale and there are the obvious synergies when his shares become re-rated and as we move into the latter stages of a precious metals bull market, these shares are going to be worth a lot more than 60 cents a share. And there was a pretty meaningful cash component to the deal as well. Dolly Varden is parting with $5 million worth of cash that Fury now can then take to advance either Eau Claire or Committee Bay.

Maurice: Now we've covered the current resources. What can you tell us about further exploration upside potential?

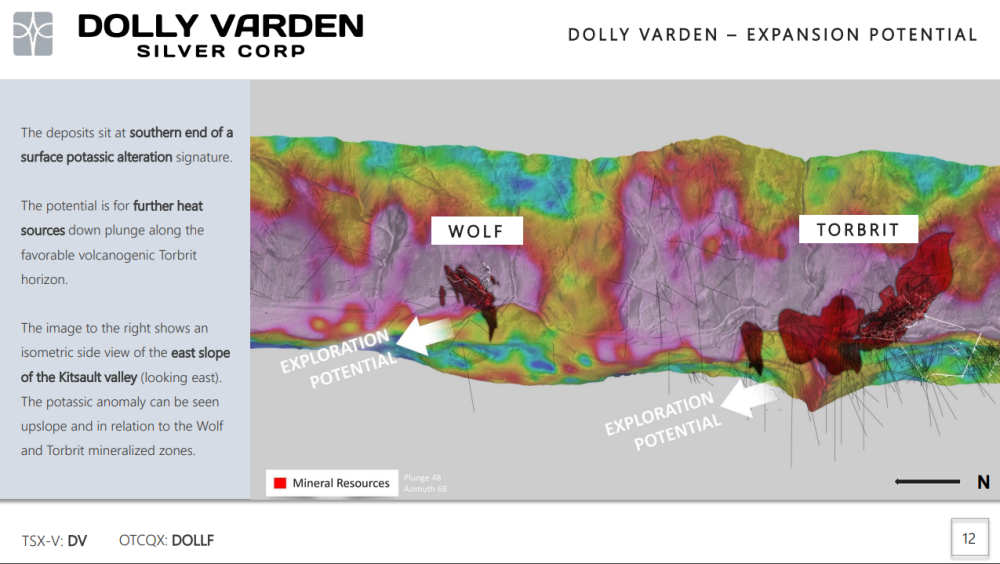

Shawn Khunkhun: The key is, so we have a northern property, northern deposit called Wolf, which is nearby Torbrit, which is the big granddaddy, 50 million ounce silver discovery on our property. Two kilometers away you have the Wolf and there's a tremendous 2-kilometer opportunity between Torbrit and Wolf.

Now going north from Wolf, you've got South Reef, which is Fury's southernmost project. The big exploration opportunity is in the 5 and a half kilometers that lie in between South Reef and Wolf. I haven't had the incentive to drill north. I'm not going to be positioning my drill rigs going on to Fury's ground, defining mineral inventory on their side of the property. Likewise, Tim Clark and the team at Fury weren't going to be drilling south. Now that we've unified, now that there's 100% interest in one entity, that is going to be a huge area of focus going forward.

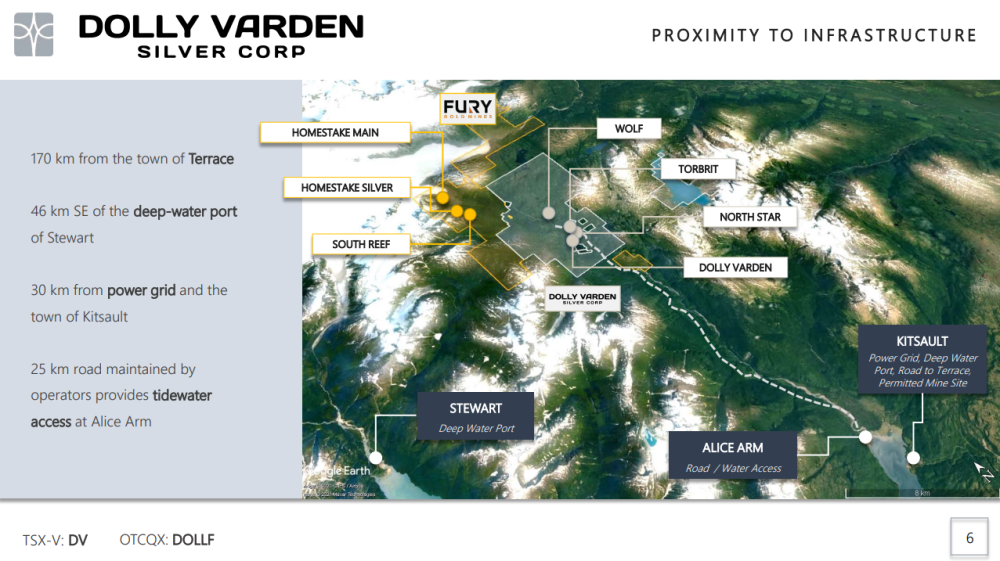

Maurice: Now to coincide with this upside potential. How will the addition of the Homestake Ridge Project impact infrastructure?

Shawn Khunkhun: There was a PEA that was produced that looked at one mill to develop the project at Homestake Ridge. The obvious synergy is for the company to release a PEA where you've got one mill, two projects. So from CAPEX to exploration to development, there are tremendous synergies by having one entity. And then I think as we are demonstrating that we are the lead consolidator in the area and if we have the hub, the mill will attract other projects that are in the area that don't have the capital, or maybe not large enough as a standalone operation, they will be coming into the Dolly Varden Mill.

Maurice: By consolidating the region Dolly Varden Silver now has a commanding land position at the southern tip of the Golden Triangle. But there's more to the transaction. You've added some icing on the cake by merging the synergies and expertise from Fury Gold Mine's technical team as well.

Shawn Khunkhun: Thank you. No, and it's not just technical, you're absolutely right. But you know, Tim Clark, his capital markets and his banking contacts, Tim, as a CEO of Fury, he spent a career in the precious metals business. He's got a Rolodex of contacts. Tim's rolling up his sleeves, he's coming on the board. In addition to having Michael Hendrickson, who is a very, very talented exploration geologist joining our board and working together as a group to unlock the true potential with the capital market's expertise, with the technical expertise, we already had a lot of depth on the technical side, right from the top with Rob McLeod, Rob van Egmond, Jodie Gibson, Ryan Weymark, Andrew Hamilton's just joined the team. And then we've got this new generation of project managers, Amanda Bennett. We've got a new gentleman joining our team here imminently, Joaquin.

We've just got, this is not going to be set out to consultants. This is in-house where the incentives are aligned with shareholders. And I've been through projects in the past where you have strong teams where the incentives are aligned with shareholders and it produces the best results. And we've got first-class people from even looking at this transaction, how it was put together from our banking advisors at Haywood to our legal counsel at Stikeman, I'm just floored and honored to work with just a high caliber of people. I've got a tremendous partner in our CFO, Ann Fehr. We've got a supportive, active board. I'm not going to mention every board member, but I want to thank our chairman, Darren Devine. We've just got a tremendous opportunity. It's a great culture. It's a culture that wants to grow, that wants to win. And now we have a platform and with size and scale that is going to attract larger investors.

I've listened to investors, I've gone out into the world. They told me to consolidate. They told me to get bigger. I've done it. And we're just getting started.

Maurice: Now before we leave the Golden Triangle, let's visit the Dolly Varden Silver Project, which conducted a 10,000-meter drill program, which was a 50/50 split between infill and expansion drilling on the high-grade Torbrit Deposit. Any updates for us and when we might expect to see some results?

Shawn Khunkhun: The labs have been extremely backed up in this part of the world. I'm anticipating results imminently and will continue to report results going into Q1. We allocated about 35% of our meters to exploration and we allocated about 65% of those meters in and around known resources. I would envision putting out two result-oriented press releases, one on exploration drilling, and one on resource expansion and extension drilling. Last year, we were extremely successful. A year hasn't gone by where Dolly Varden hasn't had dual success. I anticipate that to be the case, but what we've done here with this transaction is a material change to our mineral inventory definitively. And so I look forward to following up on exciting discoveries and drilling them out. But this is a real shot in the arm in terms of going from 44 million ounces to 140 million ounces. It's quite a feat.

Maurice: It certainly is. All right, switching gears, sir. Let's look at some numbers. Please provide us with the capital structure for Dolly Varden Silver.

Shawn Khunkhun: We currently have 130 million shares. Assuming our shareholders vote for this transaction, we're going to issue 76 million shares to Fury. Again, they're an insider. They're locking up that stock. They're riding this precious metals market with us, and they're going to help us extract maximum value from this opportunity. If the transaction is supported, Dolly Varden Silver Corp will go to 207 million shares. But again, that's 37% held by Fury. That's 37% held by precious metal institutional investors, some of them are 9.9% shareholders, that's 11% Eric Sprott, 8% retail. In addition, Hecla, which is a 10% shareholder has an opportunity to do a top-up. So they have a participation right. If Hecla exercises their participation right, they will come in for nine million shares and they will resume having a 10.5% percent ownership. Which coincidentally nets out the cash component of the transaction.

Maurice: Now, before we close Mr. Khunkhun, what would you like to say to shareholders?

Shawn Khunkhun: I came in in year one in 2020. We had a great market and we raised $27 million in a non-dilutive way. We put money in the ground. We started growing the deposit and saw an opportunity to transform the company. There were opportunities to transform the company outside of our region, we chose to expand our footprint next door, which now gives us a commanding position at the southern tip of the Golden Triangle. We're a prominent player in the area now.

And we shouldn’t ignore the catalysts’ In the region such as Pretium being subject to a takeover bid from Newmont. We saw the big takeout last year with GT Gold. This is an area that the majors want to be and we've positioned our shareholders with a commanding position at the southern tip of the Golden Triangle.

But beyond that, this is what I want to leave the readers with. There are a lot of gold projects that have ounces in the ground in North America. There are a few projects that have ounces in the ground in North America that are silver. There are only 14 companies that have both gold and silver of this size. None of them have it at this grade. We are number one. We are number one for size meets grade in precious metals.

You missed nothing Maurice. You got it all covered.

Maurice: Mr. Khunkhun, for someone that wants to learn more about Dolly Varden Silver, please share the contact details.

Shawn Khunkhun: Please visit our website, www.dollyvardensilver.com. You can follow us on Twitter @silvervarden, or you can call us toll-free at +1 800-321-8564.

Maurice: Mr. Khunkhun, it's been a pleasure speaking with you. Wishing you and Dolly Varden Silver the absolute best, sir.

And as a reminder, I'm a licensed representative for Miles Franklin Precious Metals Investments, where we provide several options to expand your precious metals portfolio from physical delivery directly to your home, off-shore depositories secured by Brinks, and precious metal IRAs. Call me directly at 855-505-1900 or you may email, maurice@milesfranklin.com. And finally, please subscribe to provenandprobable.com, where we provide mining insights and bullion sales.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Dolly Varden Silver Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Dolly Varden Silver Corp. My company has a financial relationship with the following companies referred to in this article: Dolly Varden Silver Corp. Proven and Probable disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Dolly Varden Silver Corp. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dolly Varden Silver Corp., a company mentioned in this article.

Proven and Probable Disclosure:

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Proven and Probable LLC does accept stock options and cash as payment consolidation for sponsorship. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. YOU SHOULD NOT MAKE ANY DECISION, FINANCIAL, INVESTMENTS, TRADING OR OTHERWISE, BASED ON ANY OF THE INFORMATION PRESENTED ON THIS FORUM WITHOUT UNDERTAKING INDEPENDENT DUE DILIGENCE AND CONSULTATION WITH A PROFESSIONAL BROKER OR COMPETENT FINANCIAL ADVISOR. You understand that you are using any and all Information available on or through this forum AT YOUR OWN RISK.”

All Rights Reserved.

Images provided by the author.