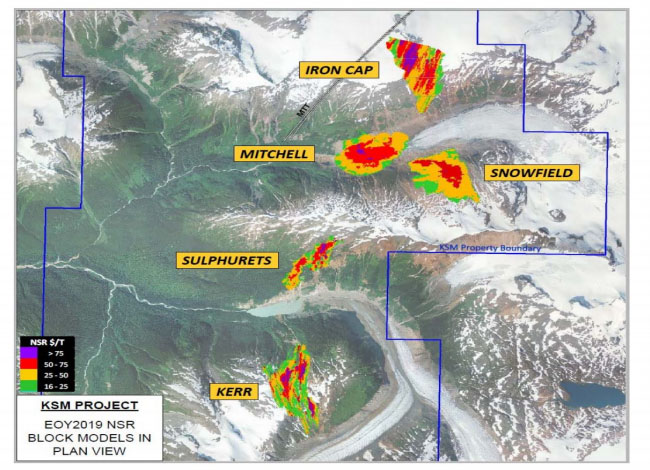

In a March 26 research note, Singular Research analyst Jim Marrone reported that Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) closed its acquisition of Snowfield, a large gold resource immediately adjacent to the company's 100%-owned KSM gold-copper projects.

"The acquisition enables exciting new development opportunities for KSM which could have a significant positive impact on project economics.," Marrone wrote.

The analyst noted that among these opportunities are environmental approvals already in place for Snowfield include haul roads through the property, which Seabridge could use to speed up development and mine its highest grades early on.

Also, "a large portion of the Snowfield mineral resource could be exploited in a combined operation, which could potentially improve KSM's internal rate of return (IRR) and net present value (NPV) projections as well as shorten the payback period of initial capital," Marrone wrote.

The analyst indicated that the next step is to complete a preliminary feasibility study for KSM plus Snowfield. Already a preliminary economic assessment (PEA) on KSM alone was done, last year, which showed that including the recently expanded, higher grade Iron Cap deposit into the mine plan would significantly enhance the project's economics.

"The PEA economic projections, if achieved, would rank KSM among the best large-scale producing mines in the world," commented Marrone.

The PEA outlines an after-tax NPV of $6 billion and an after-tax IRR of 14%, using a $1,340 per ounce gold price and a $2.80 per pound copper price.

Finally, Marrone noted that "the long term thesis for SA remains unchanged, which is that based on proven and probable reserves it controls the world's largest undeveloped gold and copper project (KSM), and that the value of this project will ultimately be realized via a JV with a major mineral producer."

We believe that while progress at Seabridge will remain slow and steady towards a JV, the direction continues to be positive," Marrone stated.

Singular has a Buy rating and a US$30 per share price target on Seabridge Gold, the stock of which is trading at about US$17.31 per share.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold and Pretium Resources. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pretium Resources, a company mentioned in this article.

Disclosures from Singular Research, Seabridge Gold, March 26, 2021

The following disclosures relate to relationships between Singular Research and Millennium Asset Management, LLC

(“Millennium”) and companies covered by Singular Research and referred to in research reports. This report has been prepared by Singular Research, a wholly owned subsidiary of Millennium which is an investment advisor registered in the State of California. Singular Research receives fees from Millennium for the right to use and distribute research reports prepared by Singular Research. Millennium does and seeks to do business with companies covered in Singular Research’s research reports. Millennium may receive fees from issuers that are the subject of research reports prepared by Singular Research for investor and public relations and other marketing-related services provided to such issuers by Millennium. As a result, investors should be aware that Singular Research and Millennium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

There are no company-specific disclosures.

The views expressed in this research report accurately reflect the responsible analyst's personal views about the subject securities or issuers. No part of the analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by that analyst in the research report.

Millennium and its affiliates, officers, directors, and employees, excluding analysts, will from time to time have long or short positions in, and buy or sell, the securities or derivatives thereof of covered companies referred to in our research reports. Our affiliates, officers, and directors won’t execute on any new recommendation or recommendation change until 48 hours after the dissemination of the report.