Maurice Jackson: Joining us for our conversation is Bob Moriarty, the founder of 321gold and 321energy.com.

Sir, in my hands, I have the Inside Story on the Greatest Gold Discovery in History, which happens to be your literary masterpiece entitled "What Became of the Crow?," which I believe may be the single most important piece of literature for anyone participating in any capacity in the natural resource space. Bob, would you please introduce us to your magnum opus, "What Became of the Crow?"

Bob Moriarty: Maurice, as you are well aware, I spent 20 years visiting two or three or four projects a month. I used to travel up to 150,000 miles a year and visited probably 500 projects. It got to the point where I was going to the same project 10 years later owned by a different company. In 2008 at the height of the Great Financial Crisis, I met Quinton Hennigh of Novo Resources, who is the main character in the book. He and I drove to the Rattlesnake Project together. And during that drive, Quinton shared his theory about how gold got into the Witwatersrand. And I thought that's interesting. Little did I know that conversation would change my life and have a profound impact on the mining space. And I got to participate in Novo Resources from a theory stage into actual production. And as much reading as I do, I've never really read a good book that tells the story about what goes on with the mining project.

Quinton Hennigh (Left) with Jayant Bhandari (Right) at Beatons Creek in 2014.

And what I wanted to do was tell as honest a story as I could. And I'll be real candid here, in the beginning of the book, I say I'm going to tell you most of the truth. If investors knew what went on behind the scenes, they would have a fit. It's a difficult, difficult business and to go from theory to production is very difficult to do. The process takes more than capital and years to come to fruition, and you must have some really good people. And I got to write the story because I was part of it right from the beginning.

Maurice Jackson: And speaking of writing the story, we all have our gifts, but you seem to have mastered many in your life as you have a unique way of conveying a story. And allow me to highlight the brilliance of your work. You've written a book that is a book within a book within a book. And here's what I mean. At first glance, one might assume that this is a book just for a geologist. And then as you read on, you discover, wait a minute, this is a must-read for any speculator buying stocks in the resource space. But then as you continue to read further, you realize this is a book for any business person, specifically—and I want to foot stomp this—for any entrepreneur. Now, I want to ask you, was this by design and how were you able to write in a way that touches each of the aforementioned?

Bob Moriarty: It was not by design. I will tell you something that everybody who's an artist or writer knows intuitively. Your brain kind of takes over, I mean, all I do is sit down at the computer, put my fingers on the keyboard and my fingers start writing. I don't know what's going to come out. It's whatever fits it with time. It used to drive my wife Barbara crazy because she would see me typing 30, 40 words per minute. And then she would read what I wrote and realized it doesn't take very much editing. And it drove her crazy because it shouldn't be that easy, but it is easy for me and I can't explain it. And there is no overall design in mind, I just wanted to write a good book. And I think I came up with a pretty good book.

Maurice Jackson: In reading What Became of the Crow?, you also get an insight into one of the most interesting people in the world, and that is Bob Moriarty. And I have to give credit where credit is due. I'm honored to say that over the years you've mentored me, and many times, I have to admit it, you've taken me apart and sometimes put me back together again. And I say that with the most profound respect for you, as one of the things that you've instilled in me is the importance of being a good steward to the space and the obligations that we have to our subscribers, to be honest, and never break their trust. And I say that because I'm often asked what's it like to speak with Bob offline? And I have to share that in reading this book, this is what it's like because you've taken through an exploration project with one of the most successful minds in history.

You provide a behind-the-scenes look into the industry that many speculators overlook. And as you've pointed out many times, it's not just the size and the grade of a deposit, it's the intangibles that many speculators overlook. Allow me to share some of the intangibles that readers will discover while reading your book that touched me. Vision, belief, team, passion, adversity, triumph, greed, backstabbing, loyalty, wealth, willingness to make mistakes and overcome those mistakes and challenging paradigms. This is so critical to understand about the industry is that it's not just numbers. Now, before we move on to companies, where can we purchase What Became of the Crow? And also if you would, what are some of the readers saying about your book?

Bob Moriarty: Okay, there are three different versions available. There is the hardback from Lulu, which is about 50 bucks and that's full color. There's a paperback from Lulu. There's black and white, that's available on both Amazon and Lulu. And there's the Kindle version, which is available on Amazon. Now, if anybody is even thinking they might be interested in this, they owe it to themselves to go to Amazon, or go to Lulu, put in What Became to the Crow?, and read the reviews. Now I buy up to 200 books a year. I got nothing better to do so I read two or three or four books a week.

It's the highest-rated book that I've ever seen and the reader comments are brilliant. And I'll be candid, if I went and saw so many incredible reviews of a book, I would buy the book. If you buy the book, you're going to be happy. And strange enough, the hardback is a high-quality book. It's something I was proud of. I was just so impressed with the quality of the book from Lulu and I think readers will be too. It's a book you're going to want to buy and keep and read 20 years from now. I think it's going to be the classic in mining history. It's that good.

Maurice Jackson: I share the same opinion. And I'm not going to wait 20 years, I shared with you before the interview, I plan on rereading the book this weekend, What Became of the Crow? Now, moving on to resource stocks that have your attention, let's begin with Novo Resources. What can you share with us?

Bob Moriarty: Now, there are two things that I want to share, and you are the first or the best person because you're the most qualified. When your children were born, how much sleep did you get the first 90 days?

Maurice Jackson: Zero.

Bob Moriarty: That's exactly how much sleep Quinton is getting right now. Second of all, you were in the military and you're quite familiar with people marching, etc. If you went out on the street and paid 50 people to come work with you, and you wanted to get them to march in formation for, say a quarter of a mile, how long would it take to train them?

Maurice Jackson: It would take weeks.

Bob Moriarty: You just made two really important points that investors simply don't understand and Quinton didn't understand. That's funny. I've talked to Quinton and he said, "Oh my God, I'm pulling my hair off." Now that was a crisis, you know Quinton, right?

Maurice Jackson: Yes, sir.

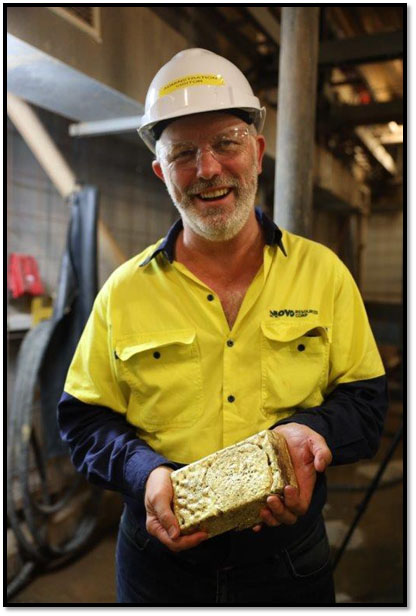

Rob Humphryson, the CEO of Novo Resources, holding Novo's inaugural gold bar from the Beatons Creek Gold Project.

Bob Moriarty: He hasn't got any hair. So when he started pulling his hair out, he's got a real problem. It's all gone. But if you're going to go into production, it's just like having a baby, forget sleeping for the next 90 days. And if you're going to get people to march in formation for a quarter of a mile, and you take 40 or 50 people together, it's going to take months to do so. Quinton and I had many conversations since the first gold poured about six weeks ago. And every time we speak he shares his frustrations with me stating: "This happened, this happened, this happened, and this happened." And he truly was concerned and I said, "Quinton, give it up. They're supposed to screw up. That's what happens. You got to get everybody marching in the same direction and it's like a brand new baby. You're not going to get any sleep for the first 90 days." And what I'll say is, and I'm kind of amazed by this, he was exceptionally concerned in the first week or two after the pour because little tiny things were blowing up.

And I said, "Quinton, that's how it's supposed to work. If you called me up and said, everything's perfect and everything's going smoothly and nothing's going wrong and everybody's doing their job exactly right"—

Maurice Jackson: Then something's wrong.

Bob Moriarty: Novo has put together an incredible team. Things are working out very well and there's going to be some real pleasant surprises. One thing that Quinton has never discussed publicly, there are two kinds of gold processing in the mill. They've got a gravity circuit and they've got a cyanide circuit. Now the gravity circuit, it's on the front end. So if you've got nuggety gold, and they are not big nuggets, they are small nuggets. If you have small nuggety gold flakes and you can take them out of the material, it means your cyanide process is going to be a lot more efficient.

So about half the gold they're recovering, they're recovering on the gravity side. And that's key, which means they can put a lot more materials than they ever suspected. So it's going to take another month or two or three to get everything sorted out. There are going to be tiny issues, and they're going to sort them out. But when investors figure out how much the throughput is and how much gold they're producing, everybody's going to be very happy. I think it's a giant success story. I'm pleased to be associated with Quinton, with Rob, with the entire team. They're just great people and they've done a brilliant job.

Maurice Jackson: Let's stick with Dr. Hennigh and get your thoughts on some of the companies in which he serves as an advisor, beginning with Irving Resources.

Bob Moriarty: Irving stumbled because of Japan. I think that a lot of countries have overreacted and Japan shut the drillers out. It's taken longer to get organized than it should have, but it's COVID. It's the same deal with the assets. Assays are now taking months and months and months; they used to take a week. But Irving has the goods, they're going to succeed and they've got a lot of gold. Irving, I think it's my second biggest holding right now. I love Irving.

Maurice Jackson: Well, if one person can get the job done, it is Akiko Levinson, the CEO of Irving Resources.

Bob Moriarty: I'm glad you said that because you're correct. I was afraid for a minute you're going to say, Quinton. Quinton does his job there, which is to assist Akiko, but Akiko is magic. And you and I know her, you and I have been over there. And the last time I was over there, I walked into where they had all the samples and Akiko was sweeping the floor. Now, that is management.

Maurice Jackson: Indeed. She's a class act by the way. Let's go to Fiji and visit Walter Berukoff in Lion One Metals.

Bob Moriarty: Interestingly enough, again, because of COVID, Lion One sort of stumbled. They ordered some drills, I think they've got $65 million in cash. Wally did a brilliant job of raising money when he could. He and I had several conversations. I said, "Look Wally, the biggest danger right now is the banking system. You need to spend that money as fast as you can on things that you're going to need for the future." Lion is drilling right now and they've got an assay lab on site. So there will be results coming out. That stock is down 15% since August. And there's nothing wrong with the stock; it's certainly cheap.

Maurice Jackson: It's a great buying opportunity, a great value proposition and it's an alkaline deposit. Let's foot stomp that, an alkaline deposit. Let's go to Nevada and let's visit Peter Ball and NV Gold.

Bob Moriarty: Interestingly enough, and it's not necessarily Nevada, Peter has been very aggressively picking up other projects. And there's no particular news yet, but they got money and they're going to do a lot of drilling next year. And there are a lot of projects, any one of which could be company making.

Maurice Jackson: Moving on to The Metallic Group of Companies, spearheaded by Greg Johnson, another prominent name in the natural resource space.

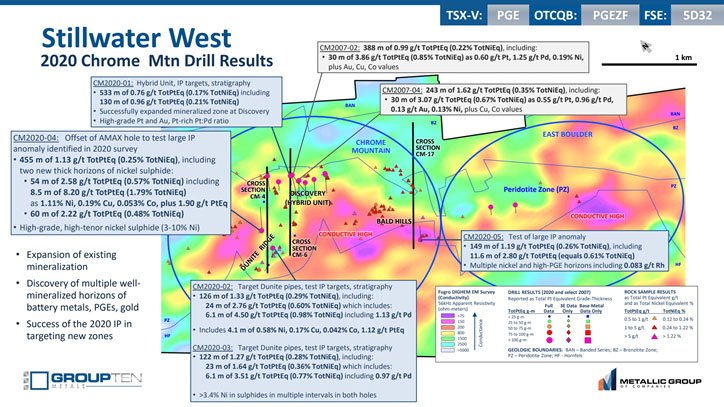

Bob Moriarty: All three companies share management. I've known Greg for 20 years now. He was the number two guy at NovaGold 20 years ago. He's brilliant. And the drill results from Group Ten Metals on the platinum-palladium Stillwater West project are exceptional. And for some reason, the market hasn't picked up on it yet. Equally interesting, the Metallic Group of Companies has a great copper project in Granite Creek Copper and a compelling silver project in Metallic Minerals. Copper and silver both look like they're going to be the most important commodities in the next segment of the bull market. So any of the Metallic Group companies I think are cheap and are going to go up a lot.

Maurice Jackson: Let's go back to Montana. You talked about exceptional grades; the other important thing is they hit on every single target. That's impressive. That shows the proof of concept. And I'm speaking of Group Ten Metals in Montana, and that is Michael Rowley. And by the way, we just released an interview with Mr. Rowley yesterday (click here). Then the copper play in the Yukon is Granite Creek copper. And we just released an interview (click here) with Tim Johnson and that was about two weeks ago and we were looking forward to speaking with Greg Johnson on the silver play, which is Metallic Minerals, soon.

Bob Moriarty: You missed the most important thing in your last press release for Group Ten Metals (click here). In the press release they came out with, on the 3rd of March, they had 455 meters of over 1.5 gram material. That's incredible in itself. When the market picks up on it, and I don't understand why the market hasn't picked up on it. But Group Ten Metals has found rhodium on the Stillwater West. Rhodium's like $25,000 an ounce. Remember us talking about it when it was $600?

Maurice Jackson: I do. And by the way, it went up recently to $29,000. So you're correct that all three companies respectively are great opportunities for someone that's looking for bargain prices with exceptional management, with a proven pedigree of success.

All right, let's move on to another company that you and I like very much, and that is Dolly Varden Silver, led by Shawn Khunkhun.

Bob Moriarty: Again, Dolly Varden is right in the heart of silver country in northern BC. Dolly Varden has a lot of silver, it has great management, it has a tight share structure. And it's just about one of the very few, almost pure plays on silver.

Maurice Jackson: Please check out our interview with CEO Shawn Khunkhun (click here).

Let's go to the Yellowknife District and visit Judson Culter of Rover Metals. They produced the 11th best drill hole in Canada last year on the Cabin Lake Gold Project.

Bob Moriarty: That's another funny one. It was not a big drill program. I think it was 2,000 meters.

Maurice Jackson: Yeah, 2,000, 2,500 no more than that.

Bob Moriarty: Yeah, exactly. And you know, if you hit anything, you look like a hero. But they came up with extraordinary results. How do you achieve the number 11 intercept in Canada with a 2,000 meter drill program? I did a piece recently on Amex and we should talk about them. They've got a 300,000-meter drill program going on. They have completed 150,000 meters. They have one home run after another, after another, after another, after another and the market doesn't get it because there's too much information. Rover had a great hole and the market kind of ignored it. There's something here going on and I don't quite understand. Check out our interview with CEO Judson Culter (click here).

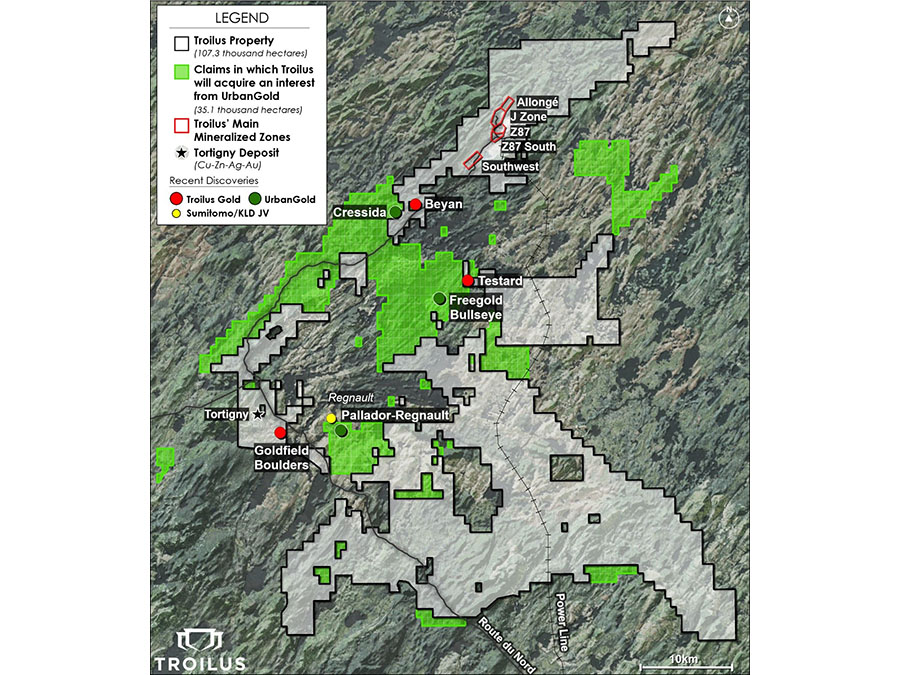

Maurice Jackson: Well, so speaking of Amex Exploration, just give us a brief overview. Where are they located, sir?

Bob Moriarty: They're in Quebec. They're right on the border with Ontario. Good management, they are absolutely in the New Found Gold, Great Bear, Walbridge camp of extraordinary results. I think their only problem is the market doesn't understand them. And I talked to management, I spent an hour on the phone with them last weekend and said, "You guys just need to broaden your reach." The danger with Amex is them being bought out too cheap. They are going to get bought out. They are going to have a 5 to 10 million ounce deposit and somebody's going to want to own them.

Maurice Jackson: Well, my eyebrows went up there. All right, moving on to physical precious metals, which metals are you buying? And why?

Bob Moriarty: Silver. Because somebody called me and could sell me 2,000 ounces at $27. And I think that that's cheap given the situation and I was happy to do it. It is fairly difficult right now to be buying precious metals because people are waking up to the fact that the Federal Reserve, it was on the verge of destroying the dollar.

Maurice Jackson: Well, let me ask you this as well. I didn't conduct any interviews regarding it, but when we had the Robinhood situation unfold a couple of months ago, a lot of clients were somewhat hitting the panic button. And I had a more of pragmatic view point. I believe the fundamentals are there for silver to move organically. Not because of some third party trying to go in there and create havoc in the market. And just want to get your thoughts on that because it reminds me of the Madness of the Crowds.

Bob Moriarty: Well, that's exactly what it is. Anytime you see a mob taking any action, you want to do exactly the opposite. There is no situation where being part of a mob is a good idea. So when a bunch of 20 something year olds go out and say, "Okay, we're going to run silver." First of all, it's bovine feces. Silver is a market like any other market. And they drove up the premiums on a temporary basis, but they're not about to corner silver. You should never buy silver because the mob says so, you should buy silver or gold or platinum, or even rhodium because they're cheap, but you should buy them when they're cheap. And you and I had three or four discussions about rhodium when it was $600 or $700 an ounce. And I'm sure you thought I was out of my mind.

Maurice Jackson: No, I didn't. I acted.

Bob Moriarty: What kind of metal goes up 40-fold?

Maurice Jackson: Yeah. Those are those unique opportunities that you only find right here on Proven & Probable. Let me ask you this as well; my favorite metal's platinum. Are you buying platinum?

Bob Moriarty: I'm not buying platinum because I've got a lot of it. Platinum's gone up, when it was $700 or $800 an ounce it absolutely was a steal. It's $1,100 and change now, went up to $1,300. You've known me long enough and there's no BS about this, I buy things because they're cheap, for no other reason than they are cheap. And if you buy things when they're cheap, you'll make money. If you insist on buying things after they've gone up and they hit a new high, you're not going to make any money.

Maurice Jackson: Bob, before we close, what keeps you up at night that we don't know about?

Bob Moriarty: I don't think anything. I think that the correction is near and end; I own some great stocks. I do worry about the warmongering from Biden and the idiots that he surrounded himself with. The U.S. is making an absolutely gigantic error in trying to mess with both the Chinese and the Russians. And it could get quite expensive.

Maurice Jackson: Last question. What did I forget to ask?

Bob Moriarty: I don't think you forgot anything. I think we've covered a lot of stuff.

Maurice Jackson: For someone who wants to find out more about your work, please share the website address.

Bob Moriarty: 321gold.com and 321energy.com. And if you want to buy the hardback, buy it directly from Lulu. Amazon plays games. If you go to Amazon and try to order the hardback, it's actually the Lulu book. And they're saying that it's out of stock and it will be a month and it's total nonsense. Go to Lulu and buy it direct from Lulu. It's a great book.

Maurice Jackson: And just for the record, I have the Kindle version, I have the paperback and the hardback is coming. And I do not benefit in any capacity financially from you purchasing your book. I'm just a big believer in great work. And this great work has repeatedly rewarded me financially by me applying the rules, the axioms that this gentleman today has shared with us.

Mr. Moriarty, it's been an absolute pleasure speaking with you today. Wishing you the best, sir.

Bob Moriarty: Good deal. It's good talking to you, Maurice. Have a good weekend. And you realize of course, when you read the book for the second time, you've got to send me some more money.

Maurice Jackson: I like that. You're a true businessman.

Bob Moriarty: Yeah.

Maurice Jackson: Will do.

Bob Moriarty: Okay. Thanks, Maurice. Have a good weekend.

Maurice Jackson: And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRAs. Give me a call at 855.505.1900 or you may email: Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide: Mining Insights and Bullion Sales, subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources, Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals, Granite Creek Copper, Dolly Varden and Rover. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Novo Resources, Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals, Granite Creek Copper, Dolly Varden and Rover are sponsors of Proven and Probable. Proven and Probable disclosures are listed below.

2) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources, Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals, Granite Creek Copper, Dolly Varden, Rover and Amex Exploration. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Novo Resources, Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals, Granite Creek Copper, Dolly Varden, Rover and Amex Exploration are sponsors of 321gold.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals, Granite Creek Copper, Dolly Varden. Click here for important disclosures about sponsor fees.

4) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

5) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals and Granite Creek Copper, companies mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.