Are you optimistic about precious metals like we are?

Then you're already outpacing the crowd . . .

You've noticed the telltale signs: unstable paper currencies, irresponsible central banking, and a worldwide economy preparing for turbulence.

So you accumulate gold. You secure silver. Perhaps in a safety deposit box, perhaps hidden at home. Regardless, you understand your metals will maintain their worth when financial institutions falter.

But here's a crucial insight many investors miss . . . During this phase of the market cycle, silver typically outperforms gold. Always has. Always will. And when silver climbs, silver mining companies climb even more dramatically.

Which explains why holding only physical metal means you're playing defensively.

The genuine offensive strategy? It's in the mining operations.

The Concealed Advantage of Leverage

Gold and silver excel at safeguarding wealth. But if you're aiming to expand it — substantially expand it — you need something with greater momentum. That's where mining companies enter the picture.

They don't merely benefit from metal price increases — they soar because of them. When gold prices advance, mining companies don't experience minor gains . . . they often skyrocket.

Consider a mining operation extracting gold at $1,000 per ounce. With gold trading at $1,200, the business nets $200 profit on each ounce. Now imagine gold jumps to $1,500. That represents a 25% increase in the metal . . . but the miner's profit margin just expanded 150% — from $200 to $500.

And if production expenses remain constant, most of that revenue flows directly to the bottom line.

This illustrates what we mean by leverage... Mining stocks don't simply track the metal. Instead, they multiply its movement. And in a rising market, that leverage creates spectacular results.

Mining Companies Are the Propellant in a Metals Bull Market

Gold might increase twofold in the upcoming market phase.

And historically, silver might triple in value . . . But the appropriate mining investments?

They could increase 5x, 10x, potentially 20x in value. That's not exaggeration. It's historical precedent. And we're witnessing the same conditions developing again today.

The industry leaders — Newmont Corp. (NEM:NYSE), Barrick Mining Corp. (ABX:TSX; B:NYSE), Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) — are certainly reliable.

But they're also sizable and closely monitored. If you want truly substantial returns, you need to explore territories Wall Street overlooks.

Valuation Gaps Wide Enough for a Semi-Truck

Enter the junior mining sector . . .

These are the small-capitalization explorers and developers quietly holding world-class assets. They haven't begun production yet. They might not even have operational mines. What they possess is verified precious metals underground, and a market that hasn't recognized their potential yet.

That's the source of their upside.

These enterprises trade at small fractions of their potential worth.

The outcome? Explosive valuation adjustments when market awareness develops.

Picture a junior gold company with 2 million ounces underground. That represents $4 billion worth of gold at present prices. Yet the company trades at merely $100 million.

Why? Because it's early-stage. Because production hasn't commenced. Because most investors remain unaware. But once the rally captures attention and junior miners enter the spotlight, suddenly. Valuations adjust. Analysts upgrade ratings. Major companies begin investigating acquisitions . . . And that quiet explorer transforms into a 1,000% gainer.

The Market Remains Largely Unaware

We're still in the early stages of this precious metals uptrend. Gold's advancing, and silver's beginning to move. But most market participants remain focused on technology, artificial intelligence, and trending stocks, which creates opportunity.

While everyone watches commercials for gold coins, sophisticated investors are quietly establishing positions in mining companies. And the juniors? They remain exceptionally undervalued—temporarily.

So, before mainstream investors realize what you and I already understand, let's examine some particularly promising junior mining operations in both gold and silver sectors. . .

Seabridge Gold

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) stands as something unique in the mining industry.

It doesn't actually extract gold. It simply owns vast quantities — exceeding 88 million ounces of measured and indicated gold and over 65 million ounces inferred just within its primary KSM project in British Columbia.

This approach, combined with disciplined financial management, provides it with the highest gold ounces per share of any publicly traded company globally..

And despite never having produced an ounce, the market still assigns substantial value to those reserves.

Why? Because in an environment starved for major gold discoveries, simply controlling the resource can suffice.

When gold prices increase, companies like Seabridge benefit tremendously — without needing to operate a single piece of equipment.

NatBridge Resources

Now envision that strategy — acquiring substantial, verified gold deposits — but with an innovative twist. That's precisely what NatBridge Resources Ltd. (NATB:CSE; NATBF:OTC; GI80:FSE) is implementing.

Similar to Seabridge, NatBridge has concentrated on securing high-quality, NI 43-101-compliant gold resources in mining-friendly jurisdictions.

But rather than merely holding them awaiting a purchaser, NatBridge advances further — digitizing the gold through blockchain technology.

Through an innovative digital asset called NatGold, NatBridge is preparing to offer tokenized, underground gold ownership to investors worldwide. As of July 30, 2025, over 35,000 NatGold tokens have been reserved by investors across hundreds of countries, exceeding $60 million in pre-market interest . . . And NatBridge maintains rights to create the initial 2.5 million tokens, positioning it as a potential conduit for other companies to digitize suitable resources through collaborative ventures.

It represents a contemporary version of Seabridge's approach. And one that might democratize global gold investment through digital asset innovations.

(Additional Note: Follow this link to discover more about NatBridge's function in this rapidly evolving ecosystem and how you can secure additional potential profits before mainstream investors or even institutional participants have the opportunity.)

Avino Silver

Avino Silver & Gold Mines Ltd. (ASM:TSX.V; ASM:NYSE.MKT; GV6:FSE) is already generating significant attention.

The company's stock nearly quadrupled year-to-date before recent consolidation, driven by its productive mine in Durango, Mexico, and increasing investor demand for silver exposure.

But this temporary pullback isn't the end. . .

Avino controls additional potential through its La Preciosa project — among the largest undeveloped primary silver resources in Mexico.

As silver resumes its upward momentum — and as additional capital rotates toward silver producers — Avino appears positioned for continued outperformance.

And if silver outpaces gold, as frequently occurs, and investment flows continue favoring producers with scale and expansion capabilities, Avino could potentially double or triple again before the cycle completes.

Apollo Silver

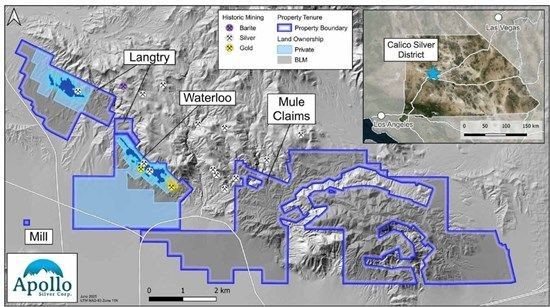

Apollo Silver Corp. (APGO:TSX.V; APGOF:OTCQB) represents another exceptionally overlooked opportunity within the resuming precious metals rally.

But its anonymity likely won't persist.

You see, Apollo controls one of the largest untapped silver deposits globally (though it's the largest within the United States).

Apollo's Calico project in Southern California contains over 110 million ounces of measured and indicated silver, plus inferred resources.

At current valuations, that's approximately $4.8 billion worth. . .

Yet its current market capitalization remains under $100 million. This means Calico alone justifies a substantially higher valuation. And then there's the unexpected potential . . . Apollo's Mexican properties, including the Cinco de Mayo project.

Should development there succeed, the market might add hundreds of millions in value almost instantaneously.

So you're looking at a flagship asset already warranting revaluation AND a secondary project that could dramatically enhance returns.

That's precisely the scenario junior mining investors dream about.

Don't Await the Crowd. Secure Assets That Multiply Now

If you're currently holding physical metals, excellent. That's foundational. Gold and silver provide protection.

But the market advance is merely beginning. And the greatest potential won't come from bullion alone. Mining companies amplify returns.

And junior miners? They can produce explosive results. Seabridge preserves assets underground. NatBridge digitalizes them. Avino extracts them. Apollo might potentially redefine the approach entirely.

These represent companies that:

- Provide unmatched amplification to metal price movements

- Trade at minimal fractions of their resource valuations

- Could experience dramatic revaluation as gold and silver markets accelerate

Whether measured by ounces per share, blockchain-enabled underground gold, dramatic early performance, or region-scale silver resources . . . This sector offers exceptional profit potential.

Now's the moment to investigate. To establish positions. To secure your investment before broader market recognition develops.

Because once that happens, these equities won't remain affordable. And the next phase of market advancement will reward those who established positions before the surge.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Seabridge Gold Inc. and NatBridge Resources Inc. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick, Pan American Silver, NatBridge Resources, and NatGold Digital Ltd.

- Jason Williams: I, or members of my immediate household or family, own securities of: Apollo Silver Corp., Avino Silver & Gold Mines Ltd., and NatBridge Resources. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.