World Copper Ltd. (WCU:TSX.V; WCUFF:OTCQX; 7LY0:FRA) is viewed as an exceptionally attractive junior copper stock here for several reasons. A big one is that the stock is at a very low price after a severe bear market with abundant technical evidence that we will examine later, which shows it is on the point of embarking on a major bull market that will be underpinned by a major bull market in copper itself.

Reasons for a major bull market in copper are the imminent major supply shortfall due to a dearth of major discoveries for many years coupled with ballooning demand due to increasing electrification involving EVs and solar, etc., and we can add to that a trend towards investment in metals generally as a means of protecting wealth from the ravages of mounting inflation caused by Central Banks ramping up money creation to stave off an implosion in the saturated debt markets.

Whilst we class World Copper as a "junior" on the basis of its current capitalization, it is important to appreciate that it is not solely an exploration company — having already defined substantial resources it is also a development and production company.

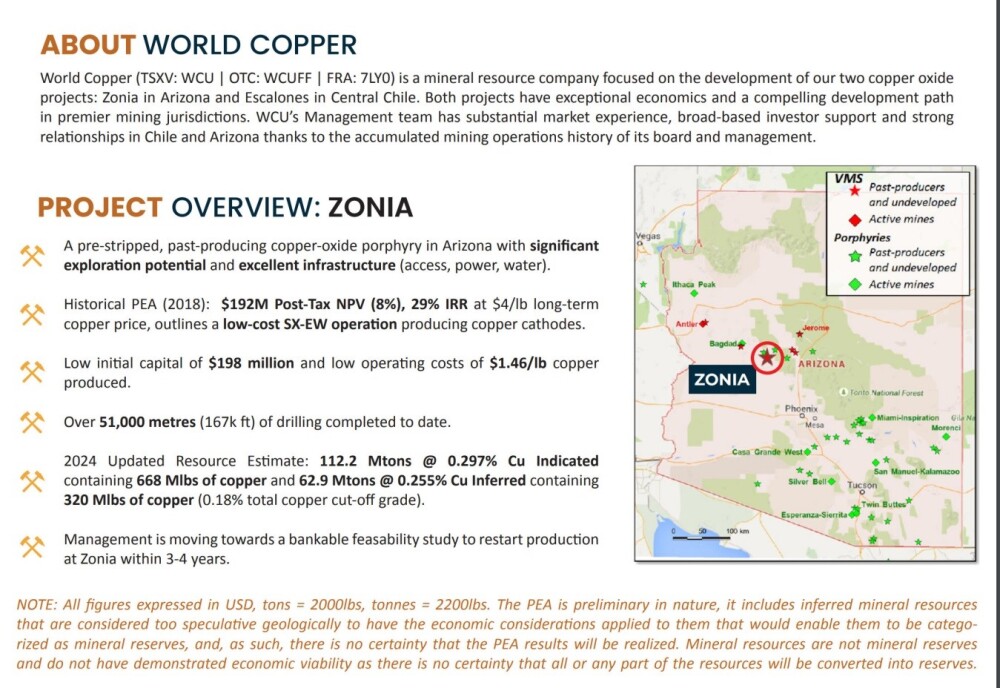

The company has two large projects with proven resources: the Zonia Project in Arizona and the Escalones Project in Chile. The following fact sheet page gives an overview of the Zonia Project.

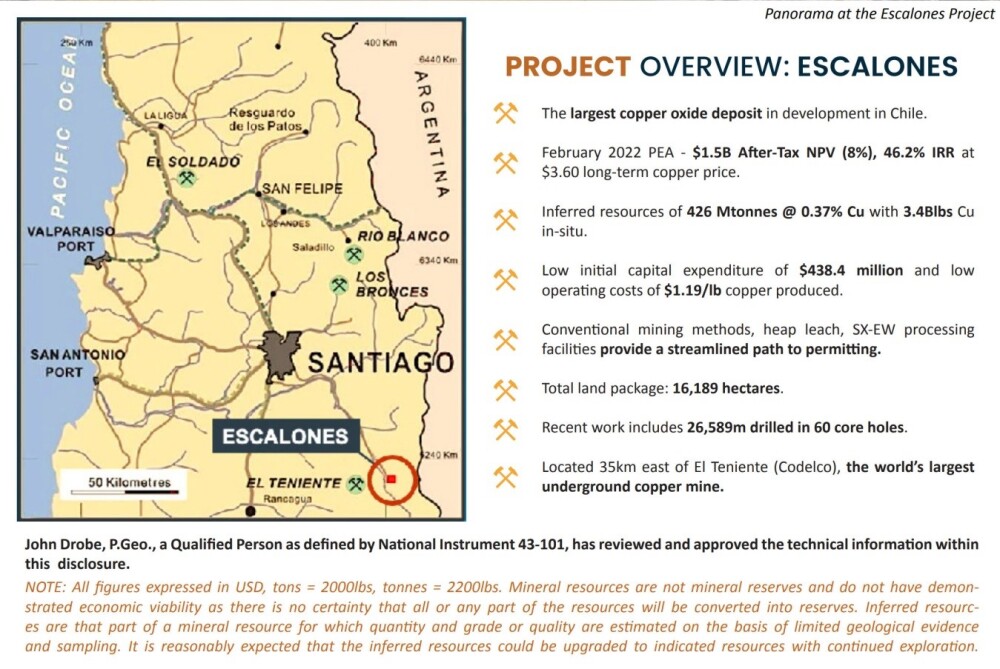

This fact sheet page gives an overview of the Escalones Project.

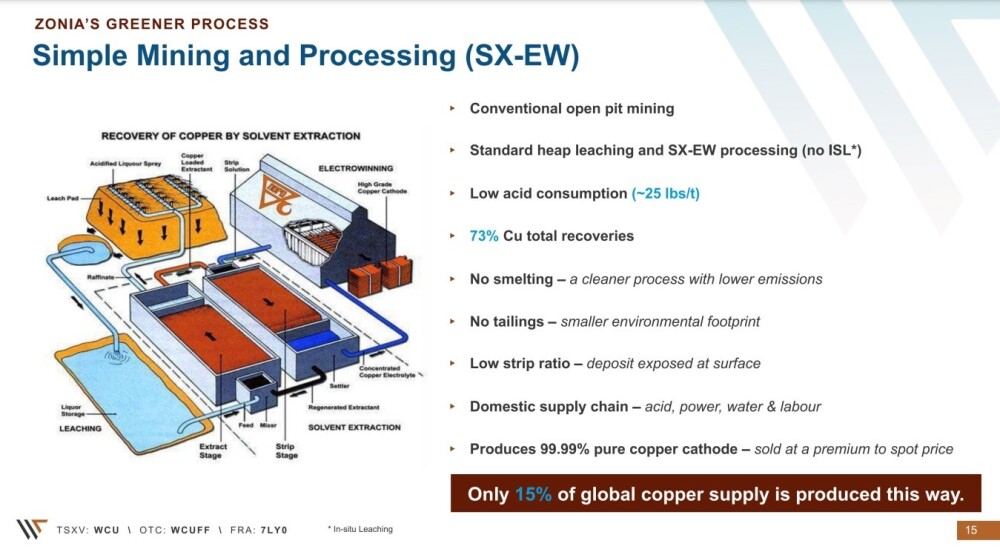

A key point for investors to understand is that the company's two projects are environmentally sound oxide projects, which are less expensive, easier to build, and much faster to put into production, and it goes without saying that a company advancing these types of projects towards production will become steadily more attractive to larger suitors wanting to gobble up such assets to increase their resource base, especially as the expected major copper bull market gains more and traction.

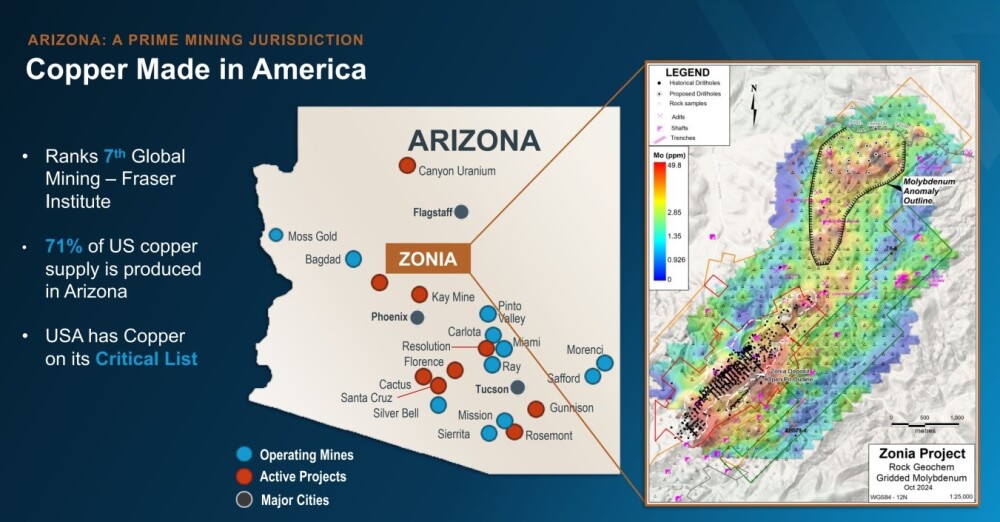

Now, we will proceed to look at the two properties in somewhat more detail using slides from the latest investor deck, starting with the Arizona property, Zonia.

This slide shows that Zonia is in good company, being in the middle of Arizona and close to many producing mines and active projects, and it also shows the location of the projects relative to several larger cities in Arizona.

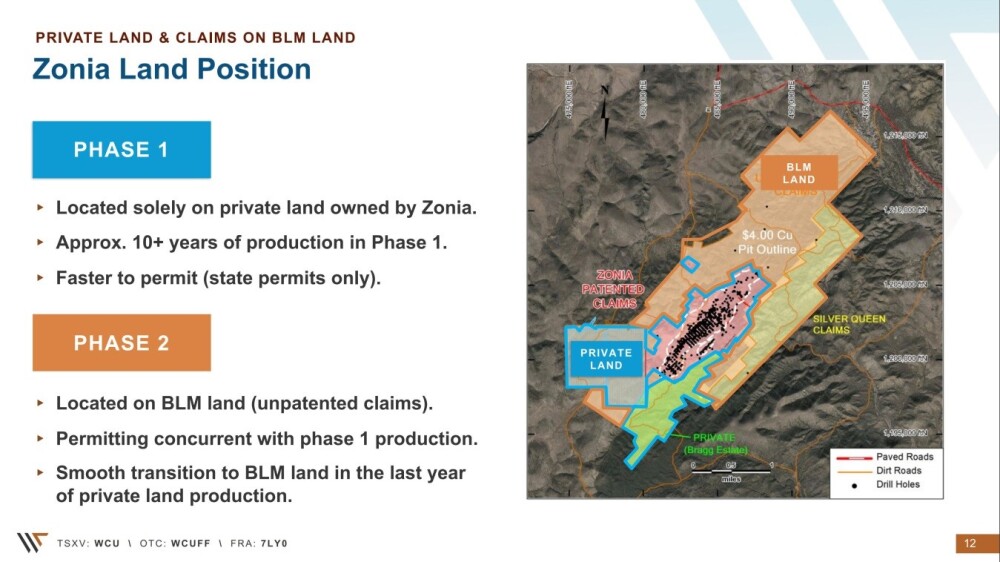

The next slide shows the Zonia land position in detail, in particular, the part located solely on private land owned by Zonia and the part that is on BLM (Bureau of land Management) land.

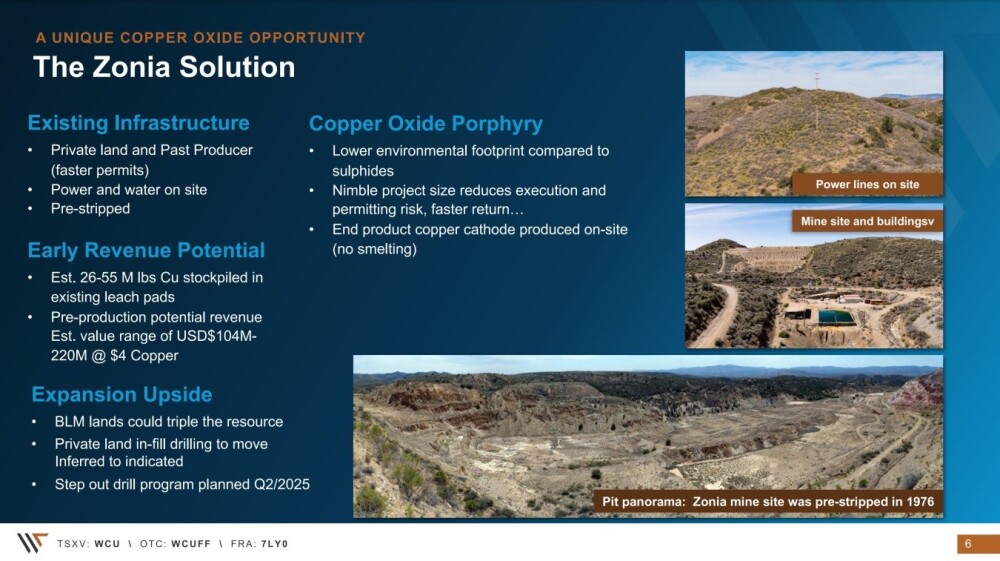

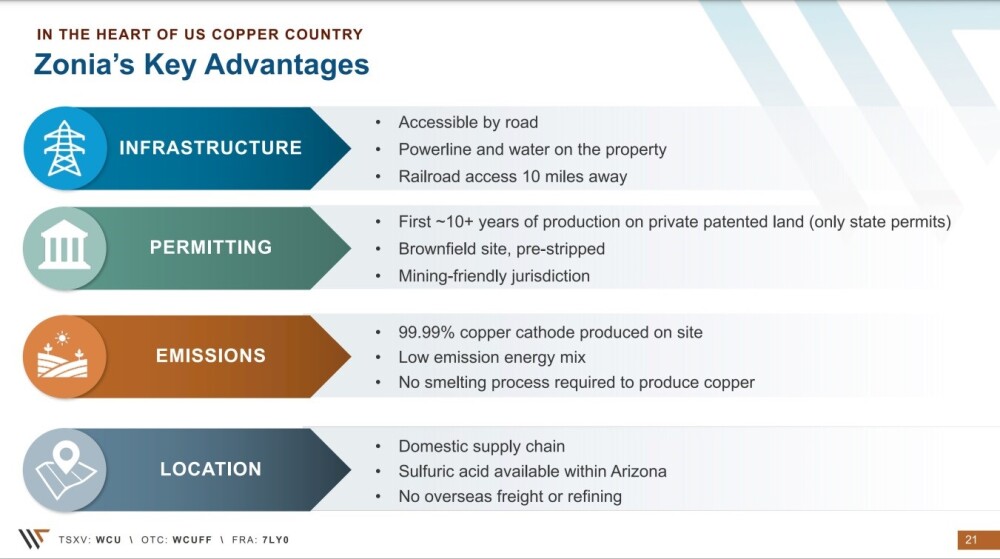

The following two slides set out the advantages of the Zonia Project.

Mining and processing of the oxide copper deposit is simpler and greener.

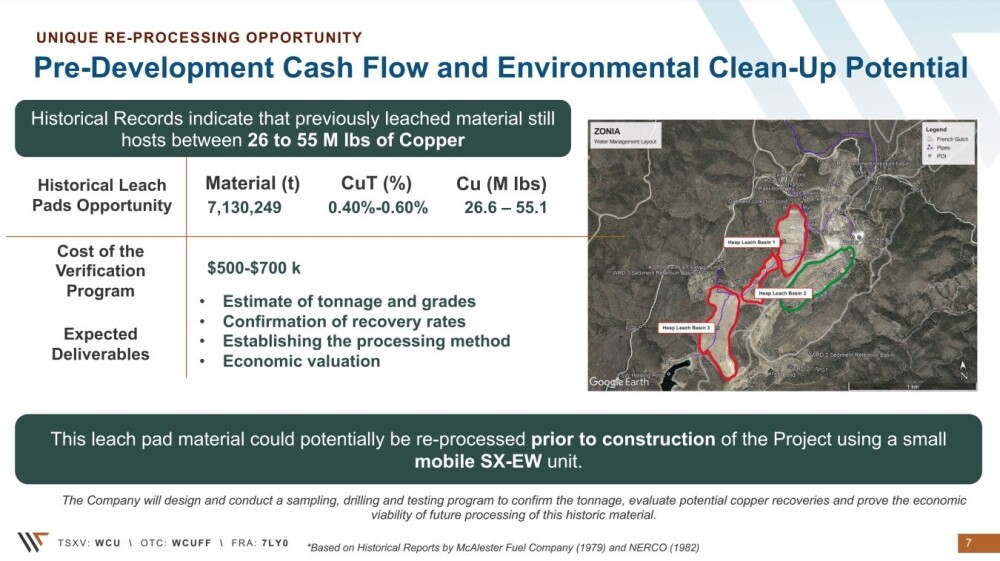

An advantage of the property is that there are three heap leach pad basins that still contain an appreciable quantity of copper, and the processing of these heap leach pads, in addition to being environmentally sound, is expected to generate significant pre-development cash flow.

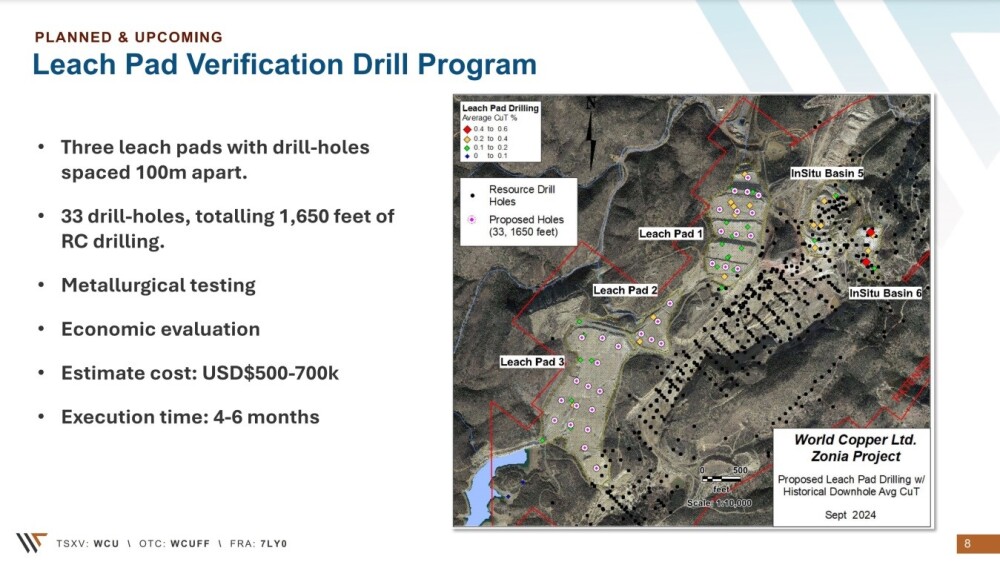

A leach pad verification drill program will be completed in the coming months.

Additional details of the Zonia property may be viewed in the investor deck.

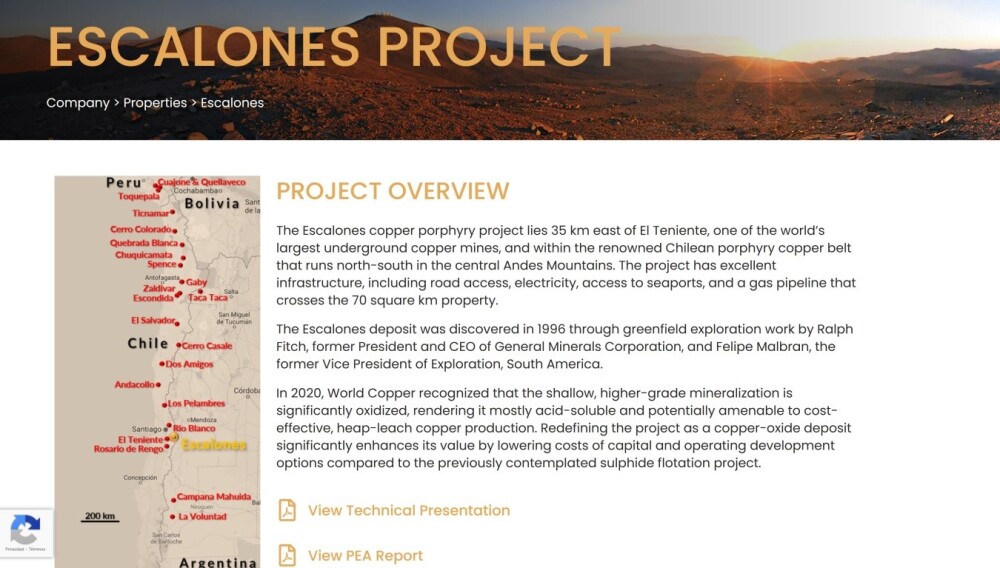

Turning now to the company's other big project, the Escalones Project in Chile, perhaps the most important point to make is that it is only 35 km east of El Teniente, which is operated by Codelco and is the world's largest underground copper mine. While this doesn't guarantee that the property has big copper deposits, it certainly makes it much more likely.

This slide overviews the project and shows its location relative to the other big projects in the Chilean porphyry copper belt.

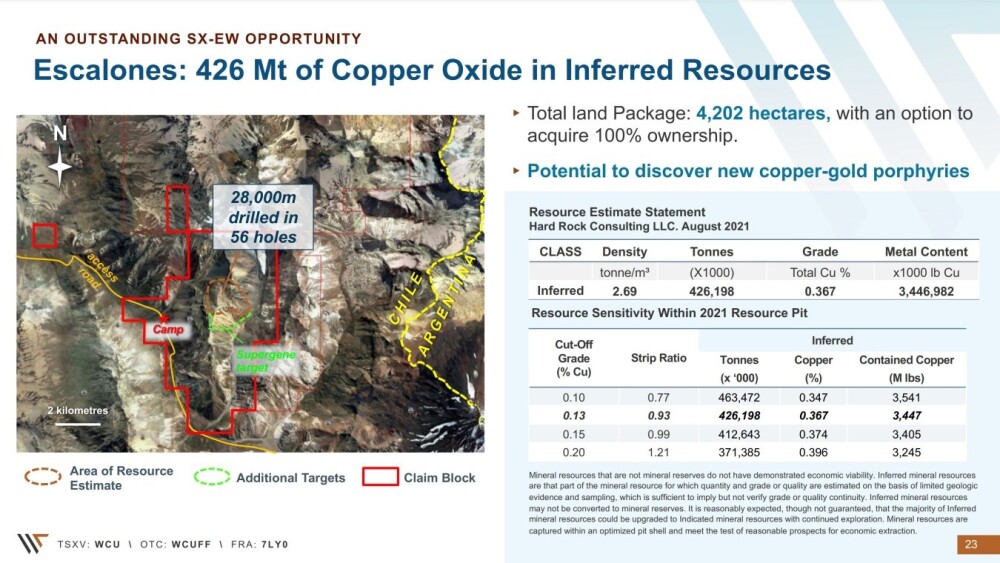

They appear to have already found a substantial quantity of copper there.

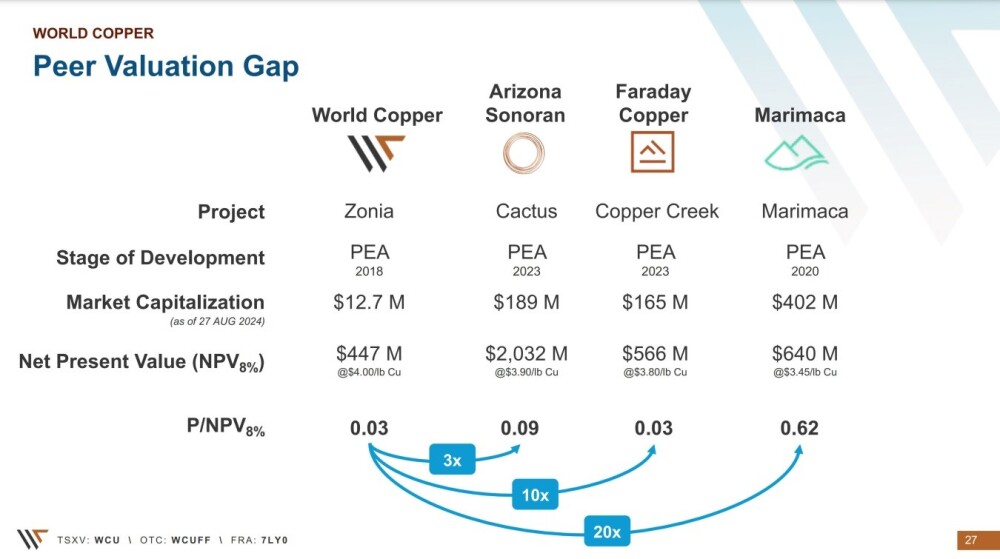

The following table should be inspiring to would-be investors in the company as it shows it to be seriously undervalued relative to its peers, albeit that in the case of Faraday Copper the decimal point appears to have been put in the wrong place.

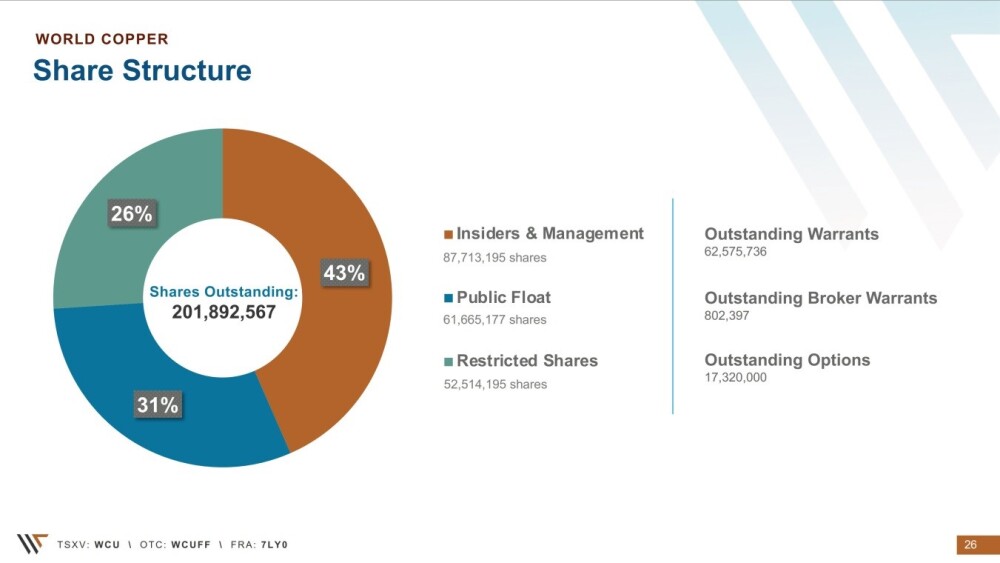

While the number of shares in issue may appear to be somewhat on the high side for such a company, the following slide reveals that Insiders and Management own a substantial 43% of them so that, factoring in restricted shares, only 61.6 million of them are in the public float.

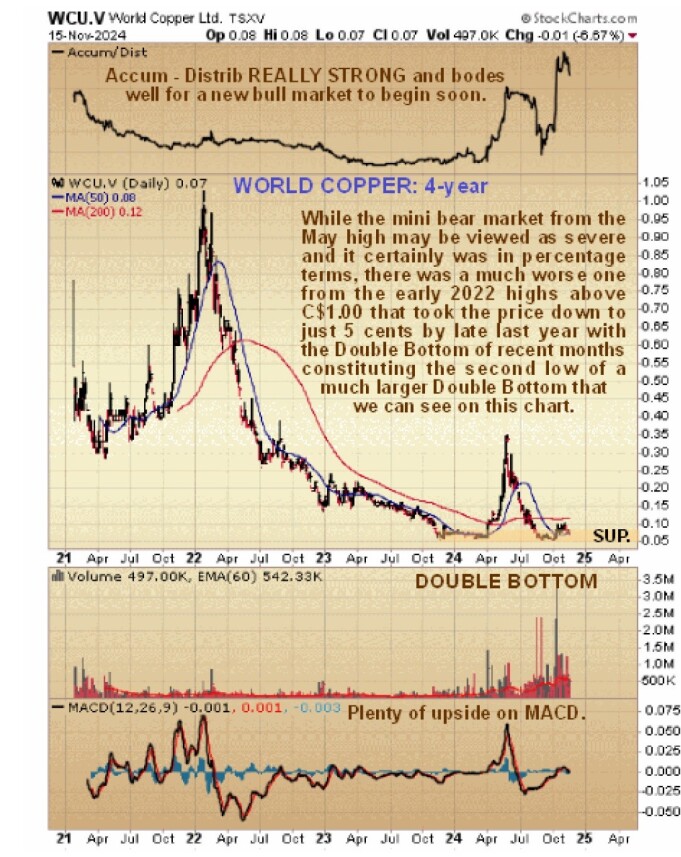

Turning now to the charts for World Copper and starting with its longer-term 4-year chart, we see that it is trading at a historically very low price following a severe bear market from its early 2022 highs above CA$1.00 that brought it down to hit bottom at just 5 cents and given the acute copper supply shortfall that is bearing down on the market and set to hit soon, it is viewed as an exceedingly attractive investment here.

In recent months, the price has formed a large Double Bottom with its lows of late last year and early this year, with the persistent heavy volume of recent months showing that a lot of stock has rotated from weaker to stronger hands, which increases the likelihood of a major new bull market gaining traction soon, especially as most of this volume was upside volume, as revealed by the soaring Accumulation line shown at the top of the chart which certainly bodes well for renewed advance.

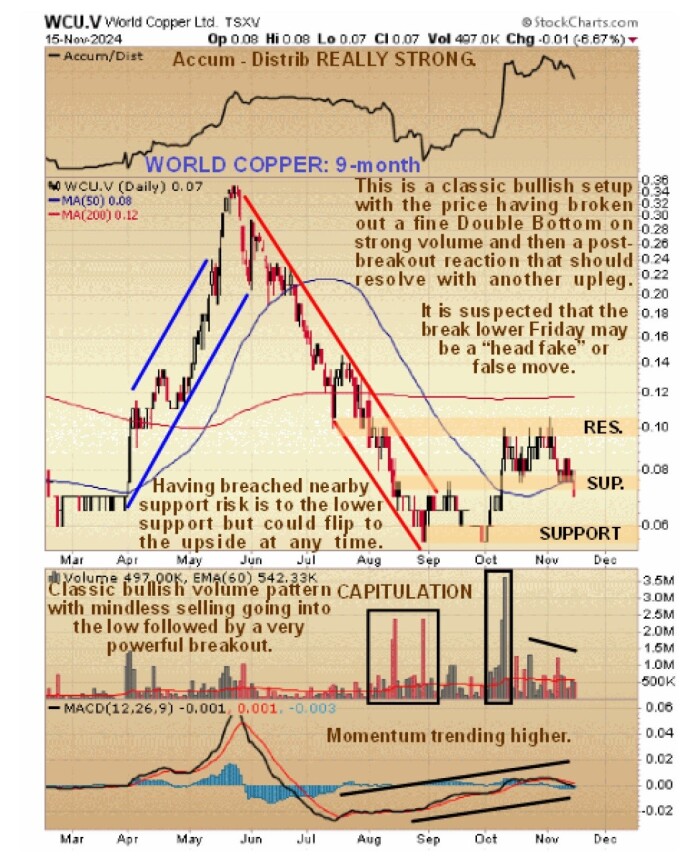

On the 9-month chart, we can see the lesser bull and bear market that formed this year between the two lows of the Double Bottom, but although classed as lesser in relation to the early 2022 high, it certainly involved big percentage moves in both directions with an orderly steep uptrend followed by an orderly steep downtrend as shown on the chart.

With the heavy downside volume in August, a symptom of "capitulation," the downtrend exhausted itself soon after and was followed by a smaller Double Bottom whose first low was late in August and followed by a second low late in September.

Zooming in closer via the 4-month chart, we can see that there was a powerful high volume breakout above the resistance, marking the upper boundary of the Double Bottom early in October, with this move being taken to mark the start of an important new bull market. The price has since consolidated / reacted following this breakout move, pressed lower by the decline in the copper price.

Although it breached nearby support at the upper boundary of the recent base pattern on Friday, which has opened up the risk of further modest decline back towards the support at the Double Bottom lows, this move is suspected to be a "head fake" or false move, especially as the candles that formed in copper itself late last week are bullish, suggesting that copper is about to reverse to the upside after its recent drop, as we can see on copper's 4-month chart below.

If so, then this is a very good point to buy World Copper.

When World Copper rose quite sharply and broke out of its Double Bottom early in October, the copper price was actually falling, as we can see on copper's 4-month chart below, but the sharp drop in the copper price over the past week got too much for it which is why it has retreated back to the support at the top of the earlier base pattern, but, as mentioned above, copper looks poised to reverse back to the upside from here and if it does this will obviously help World Copper do likewise.

World Copper is therefore rated a Strong Buy here for all time horizons.

World Copper's website.

World Copper Ltd. (WCU:TSX.V; WCUFF:OTCQX; 7LY0:FRA) closed for trading at CA$0.075, US$0.055 on November 15, 2024.

| Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- World Copper Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of World Copper Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.