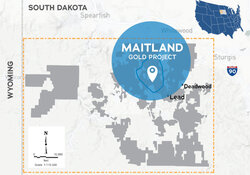

Canaccord Genuity Corp. analyst Peter Bell, in a research report published on June 20, 2024, provided an update on Dakota Gold Corp. (DC:NYSE American) following the company's announcement of drill results from eight additional holes targeting the JB Gold Zone at its Maitland Gold Project in South Dakota. The analyst maintained a Speculative Buy rating and a target price of US$5.75 on the stock.

"This morning, Dakota announced the results of eight additional drill holes targeting the JB Gold Zone at its Maitland Gold Project in South Dakota," Bell noted. "Drilling in the JB Gold Zone is testing for Homestake Mine-Style gold mineralization and is one of three ongoing programs being advanced by the Company - the other two being Tertiary epithermal gold mineralization in the Unionville Zone at Maitland and the infill and step-out drilling at the Richmond Hill Gold Project to update to the S-K 1300 resource estimate."

Highlighted drill results include:

• Hole MA24C-050: 9.46 grams per tonne gold (g/t Au) over 6.4m from 506.2m

• Hole MA23C-024: 3.84 g/t Au over 5.5m from 956.2m, including 4.70 g/t Au over 2.0m from 906.1m

• Hole MA23C-031: 4.45 g/t Au over 3.6m from 361.7m, including 5.25 g/t Au over 2.50m from 362.7m

Bell views these results as neutral, stating, "Dakota continues to extend and better understand the high-grade mineralization at Maitland. Having identified three distinct ledges within the JB Zone the company continues to drill within tighter spacings in order to further delineate the mineralization within these ledges."

The analyst believes that the results are in line with expectations for the JB Zone, demonstrating "the prospectivity for a substantial Homestake-style deposit and underscore the continuity of mineralization at JB." Bell added, "In our view, the continued advancement of Homestake-style targets adds excitement and optionality to the Richmond Hill deposit located to the west."

Dakota Gold's strategic focus on advancing three concurrent drilling programs demonstrates the company's commitment to exploring and developing its South Dakota gold assets. The ongoing drill results are identified as a potential near-term catalyst for the stock.

Canaccord Genuity's valuation methodology for Dakota Gold is based on a multiple of the company's forward curve-derived operating net asset value (NAV). "Our target is predicated on a 1.0x multiple applied to our forward curve-derived operating NAV less net debt and other corporate adjustments," Bell explained.

Dakota Gold was given a Speculative Buy rating and a target price of US$5.75, representing a significant potential upside from the price at the time of the report of US$2.30.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Dakota Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dakota Gold Corp.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Canaccord Genuity Corp., Dakota Gold Corp., June 20, 2024

Analyst Certification Each authoring analyst of Canaccord Genuity whose name appears on the front page of this research hereby certifies that (i) the recommendations and opinions expressed in this research accurately reflect the authoring analyst’s personal, independent and objective views about any and all of the designated investments or relevant issuers discussed herein that are within such authoring analyst’s coverage universe and (ii) no part of the authoring analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the authoring analyst in the research, and (iii) to the best of the authoring analyst’s knowledge, she/he is not in receipt of material non-public information about the issuer. Analysts employed outside the US are not registered as research analysts with FINRA. These analysts may not be associated persons of Canaccord Genuity LLC and therefore may not be subject to the FINRA Rule 2241 and NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account.

Sector Coverage Individuals identified as “Sector Coverage” cover a subject company’s industry in the identified jurisdiction, but are not authoring analysts of the report.

Commodity price risk: As a precious metals exploration and development company, Dakota’s future revenue is dependent on the price of gold. Mining risk: Dakota faces the typical risks inherent to mining companies relating to operating and capital costs, availability of capital, permitting requirements and timelines, technical and operating parameters, reserve and resource models, social license and community relations, taxation and royalty regimes, and regulatory and political risks. Development risk: Dakota Gold has various properties in South Dakota, USA, and is engaging in exploration activities to possibly advance them to a producing mine in the future. The company faces risks associated with developing the project, including capital and operating cost risk, financing, project permitting and timelines, and technical risks to achieve the planned operating rates. Exploration risk: Our model assumes continued exploration success in the Homestake District, as it assumes completed drill results will be brought into a NI 43-101 / S-K 1300 compliant mineral resource/reserve estimate and eventually converted into a producing mine. If the company does not find additional success with the drill bit, there is material downside to our base case valuation. Permitting risk: The properties in the Homestake District are in a very early stage, and, as such, has yet to engage in permitting outside of those required for exploration. As such, the company may not be able to proceed with the project as it is currently envisaged if the required permits to mine on the property are not received. Financing risk: As a pre-cash-flow development company, Dakota is reliant on the capital markets to remain a going concern. At present, the company has a cash position of US$35M (as of June 30, 2022), which positions it well in the near term to continue to advance its portfolio of exploration-stage projects. We note that there is no guarantee that Dakota will be able to access capital markets in the future, as the result of potential changes in market sentiment/pricing and/or concerns involving project feasibility. As such, there is no guarantee that the company will be able to secure the required funds to advance its projects in the Homestake District, including but not limited to debt/equity financing and/or a strategic investment. Delineation of gold resources: We currently model a conceptual resource, which is not considered economic as defined by 43-101 / S-K 1300. Conversion of drill hole intercepts into mineral resources and subsequently to reserves is largely a product of drill density as well as the applied economic parameters, which include commodity price and cut-off grades applied to the resource. Should the company not be able to find the conceptual resource we project, or not be able to convert the resources to reserves, this would decrease our life of mine and therefore economics for the project, all else equal. With such a preliminary conceptual mine plan, we caution investors that risk is high. Dakota has yet to achieve even a maiden resource for this project and has only performed a limited amount of drilling. Based on our industry experience coupled with historic drill results, and the drilling performed to date, we have utilized a volume-weighted average mass-based tabulation of available data (grade multiplied by width). This is a crude resource calculation method and presents considerable risk to our base case. We do not have access to all drill hole intercepts and do not employ 3D modelling software such as DataMine or LeapFrog.

Required Company-Specific Disclosures (as of date of this publication) Dakota Gold Corp. currently is, or in the past 12 months was, a client of Canaccord Genuity or its affiliated companies. During this period, Canaccord Genuity or its affiliated companies provided investment banking services to Dakota Gold Corp.. In the past 12 months, Canaccord Genuity or its affiliated companies have received compensation for Investment Banking services from Dakota Gold Corp. . Canaccord Genuity or one or more of its affiliated companies intend to seek or expect to receive compensation for Investment Banking services from Dakota Gold Corp. in the next three months. An analyst has visited the material operations of Dakota Gold Corp.. Partial payment was received for the related travel costs.

Past performance In line with Article 44(4)(b), MiFID II Delegated Regulation, we disclose price performance for the preceding five years or the whole period for which the financial instrument has been offered or investment service provided where less than five years. Please note price history refers to actual past performance, and that past performance is not a reliable indicator of future price and/or performance.

Online Disclosures Up-to-date disclosures may be obtained at the following website (provided as a hyperlink if this report is being read electronically) http://disclosures.canaccordgenuity.com/EN/Pages/default.aspx; or by sending a request to Canaccord Genuity Corp. Research, Attn: Disclosures, P.O. Box 10337 Pacific Centre, 2200-609 Granville Street, Vancouver, BC, Canada V7Y 1H2; or by sending a request by email to disclosures@cgf.com. The reader may also obtain a copy of Canaccord Genuity’s policies and procedures regarding the dissemination of research by following the steps outlined above.

General Disclaimers See “Required Company-Specific Disclosures” above for any of the following disclosures required as to companies referred to in this report: manager or co-manager roles; 1% or other ownership; compensation for certain services; types of client relationships; research analyst conflicts; managed/co-managed public offerings in prior periods; directorships; market making in equity securities and related derivatives. For reports identified above as compendium reports, the foregoing required company-specific disclosures can be found in a hyperlink located in the section labeled, “Compendium Reports.” “Canaccord Genuity” is the business name used by certain wholly owned subsidiaries of Canaccord Genuity Group Inc., including Canaccord Genuity LLC, Canaccord Genuity Limited, Canaccord Genuity Corp., and Canaccord Genuity (Australia) Limited, an affiliated company that is 80%-owned by Canaccord Genuity Group Inc. The authoring analysts who are responsible for the preparation of this research are employed by Canaccord Genuity Corp. a Canadian broker-dealer with principal offices located in Vancouver, Calgary, Toronto, Montreal, or Canaccord Genuity LLC, a US broker-dealer with principal offices located in New York, Boston, San Francisco and Houston, or Canaccord Genuity Limited., a UK broker-dealer with principal offices located in London (UK) and Dublin (Ireland), or Canaccord Genuity (Australia) Limited, an Australian broker-dealer with principal offices located in Sydney and Melbourne. The authoring analysts who are responsible for the preparation of this research have received (or will receive) compensation based upon (among other factors) the Investment Banking revenues and general profits of Canaccord Genuity. However, such authoring analysts have not received, and will not receive, compensation that is directly based upon or linked to one or more specific Investment Banking activities, or to recommendations contained in the research. Some regulators require that a firm must establish, implement and make available a policy for managing conflicts of interest arising as a result of publication or distribution of research. This research has been prepared in accordance with Canaccord Genuity’s policy on managing conflicts of interest, and information barriers or firewalls have been used where appropriate. Canaccord Genuity’s policy is available upon request. The information contained in this research has been compiled by Canaccord Genuity from sources believed to be reliable, but (with the exception of the information about Canaccord Genuity) no representation or warranty, express or implied, is made by Canaccord Genuity, its affiliated companies or any other person as to its fairness, accuracy, completeness or correctness. Canaccord Genuity has not independently verified the facts, assumptions, and estimates contained herein. All estimates, opinions and other information contained in this research constitute Canaccord Genuity’s judgement as of the date of this research, are subject to change without notice and are provided in good faith but without legal responsibility or liability. From time to time, Canaccord Genuity salespeople, traders, and other professionals provide oral or written market commentary or trading strategies to our clients and our principal trading desk that reflect opinions that are contrary to the opinions expressed in this research. Canaccord Genuity’s affiliates, principal trading desk, and investing businesses also from time to time make investment decisions that are inconsistent with the recommendations or views expressed in this research. This research is provided for information purposes only and does not constitute an offer or solicitation to buy or sell any designated investments discussed herein in any jurisdiction where such offer or solicitation would be prohibited. As a result, the designated investments discussed in this research may not be eligible for sale in some jurisdictions. This research is not, and under no circumstances should be construed as, a solicitation to act as a securities broker or dealer in any jurisdiction by any person or company that is not legally permitted to carry on the business of a securities broker or dealer in that jurisdiction. This material is prepared for general circulation to clients and does not have regard to the investment objectives, financial situation or particular needs of any particular person. Investors should obtain advice based on their own individual circumstances before making an investment decision. To the fullest extent permitted by law, none of Canaccord Genuity, its affiliated companies or any other person accepts any liability whatsoever for any direct or consequential loss arising from or relating to any use of the information contained in this research.

Research Distribution Policy Canaccord Genuity research is posted on the Canaccord Genuity Research Portal and will be available simultaneously for access by all of Canaccord Genuity’s customers who are entitled to receive the firm's research. In addition research may be distributed by the firm’s sales and trading personnel via email, instant message or other electronic means. Customers entitled to receive research may also receive it via third party vendors. Until such time as research is made available to Canaccord Genuity’s customers as described above, Authoring Analysts will not discuss the contents of their research with Sales and Trading or Investment Banking employees without prior compliance consent. For further information about the proprietary model(s) associated with the covered issuer(s) in this research report, clients should contact their local sales representative.

Short-Term Trade Ideas

Research Analysts may, from time to time, discuss “short-term trade ideas” in research reports. A short-term trade idea offers a near-term view on how a security may trade, based on market and trading events or catalysts, and the resulting trading opportunity that may be available. Any such trading strategies are distinct from and do not affect the analysts' fundamental equity rating for such stocks. A short-term trade idea may differ from the price targets and recommendations in our published research reports that reflect the research analyst's views of the longer-term (i.e. one-year or greater) prospects of the subject company, as a result of the differing time horizons, methodologies and/or other factors. It is possible, for example, that a subject company's common equity that is considered a long-term ‘Hold' or 'Sell' might present a short-term buying opportunity as a result of temporary selling pressure in the market or for other reasons described in the research report; conversely, a subject company's stock rated a long-term 'Buy' or “Speculative Buy’ could be considered susceptible to a downward price correction, or other factors may exist that lead the research analyst to suggest a sale over the short-term. Short-term trade ideas are not ratings, nor are they part of any ratings system, and the firm does not intend, and does not undertake any obligation, to maintain or update short-term trade ideas. Short-term trade ideas are not suitable for all investors and are not tailored to individual investor circumstances and objectives, and investors should make their own independent decisions regarding any securities or strategies discussed herein. Please contact your salesperson for more information regarding Canaccord Genuity’s research.

For Canadian Residents: This research has been approved by Canaccord Genuity Corp., which accepts sole responsibility for this research and its dissemination in Canada. Canaccord Genuity Corp. is registered and regulated by the Canadian Investment Regulatory Organization (CIRO) and is a Member of the Canadian Investor Protection Fund. Canadian clients wishing to effect transactions in any designated investment discussed should do so through a qualified salesperson of Canaccord Genuity Corp. in their particular province or territory. For United States Persons: Canaccord Genuity LLC, a US registered broker-dealer, accepts responsibility for this research and its dissemination in the United States. This research is intended for distribution in the United States only to certain US institutional investors. US clients wishing to effect transactions in any designated investment discussed should do so through a qualified salesperson of Canaccord Genuity LLC. Analysts employed outside the US, as specifically indicated elsewhere in this report, are not registered as research analysts with FINRA. These analysts may not be associated persons of Canaccord Genuity LLC and therefore may not be subject to the FINRA Rule 2241 and NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account. For United Kingdom and European Residents: This research is distributed in the United Kingdom and elsewhere Europe, as third party research by Canaccord Genuity Limited, which is authorized and regulated by the Financial Conduct Authority. This research is for distribution only to persons who are Eligible Counterparties or Professional Clients only and is exempt from the general restrictions in section 21 of the Financial Services and Markets Act 2000 on the communication of invitations or inducements to engage in investment activity on the grounds that it is being distributed in the United Kingdom only to persons of a kind described in Article 19(5) (Investment Professionals) and 49(2) (High Net Worth companies, unincorporated associations etc) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended). It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. This material is not for distribution in the United Kingdom or elsewhere in Europe to retail clients, as defined under the rules of the Financial Conduct Authority. For Jersey, Guernsey and Isle of Man Residents: This research is sent to you by Canaccord Genuity Wealth (International) Limited (CGWI) for information purposes and is not to be construed as a solicitation or an offer to purchase or sell investments or related financial instruments. This research has been produced by an affiliate of CGWI for circulation to its institutional clients and also CGWI. Its contents have been approved by CGWI and we are providing it to you on the basis that we believe it to be of interest to you. This statement should be read in conjunction with your client agreement, CGWI's current terms of business and the other disclosures and disclaimers contained within this research. If you are in any doubt, you should consult your financial adviser. CGWI is licensed and regulated by the Guernsey Financial Services Commission, the Jersey Financial Services Commission and the Isle of Man Financial Supervision Commission. CGWI is registered in Guernsey and is a wholly owned subsidiary of Canaccord Genuity Group Inc. For Australian Residents: This research is distributed in Australia by Canaccord Genuity (Australia) Limited ABN 19 075 071 466 holder of AFS Licence No 234666. To the extent that this research contains any advice, this is limited to general advice only. Recipients should take into account their own personal circumstances before making an investment decision. Clients wishing to effect any transactions in any financial products discussed in the research should do so through a qualified representative of Canaccord Genuity (Australia) Limited or its Wealth Management affiliated company, Canaccord Genuity Financial Limited ABN 69 008 896 311 holder of AFS Licence No 239052. This report should be read in conjunction with the Financial Services Guide available here - Financial Services Guide. For Hong Kong Residents: This research is distributed in Hong Kong by Canaccord Genuity (Hong Kong) Limited which is licensed by the Securities and Futures Commission. This research is only intended for persons who fall within the definition of professional investor as defined in the Securities and Futures Ordinance. It is not intended to be distributed or passed on, directly or indirectly, to any other class of persons. Recipients of this report can contact Canaccord Genuity (Hong Kong) Limited. (Contact Tel: +852 3919 2561) in respect of any matters arising from, or in connection with, this research.

Additional information is available on request. Copyright © Canaccord Genuity Corp. 2024 – Member CIRO/Canadian Investor Protection Fund Copyright © Canaccord Genuity Limited. 2024 – Member LSE, authorized and regulated by the Financial Conduct Authority. Copyright © Canaccord Genuity LLC 2024 – Member FINRA/SIPC Copyright © Canaccord Genuity (Australia) Limited. 2024 – Participant of ASX Group, Cboe Australia and of the NSX. Authorized and regulated by ASIC. All rights reserved. All material presented in this document, unless specifically indicated otherwise, is under copyright to Canaccord Genuity Corp., Canaccord Genuity Limited, Canaccord Genuity LLC or Canaccord Genuity Group Inc. None of the material, nor its content, nor any copy of it, may be altered in any way, or transmitted to or distributed to any other party, without the prior express written permission of the entities listed above. None of the material, nor its content, nor any copy of it, may be altered in any way, reproduced, or distributed to any other party including by way of any form of social media, without the prior express written permission of the entities listed above.