Goldshore Resources Inc. (TSXV: GSHR;OTCQB: GSHRF ;FWB: 8X00) has put in a splendid performance in the two months since it was recommended for purchase early in February, more than doubling in price, and the good news is that even though it is entitled to consolidate here and perhaps react back some after its latest upleg, long-term charts suggest that it is eventually headed much higher against the background of an accelerating sector bull market.

Before reviewing the latest charts, it is worth looking at the following tables again.

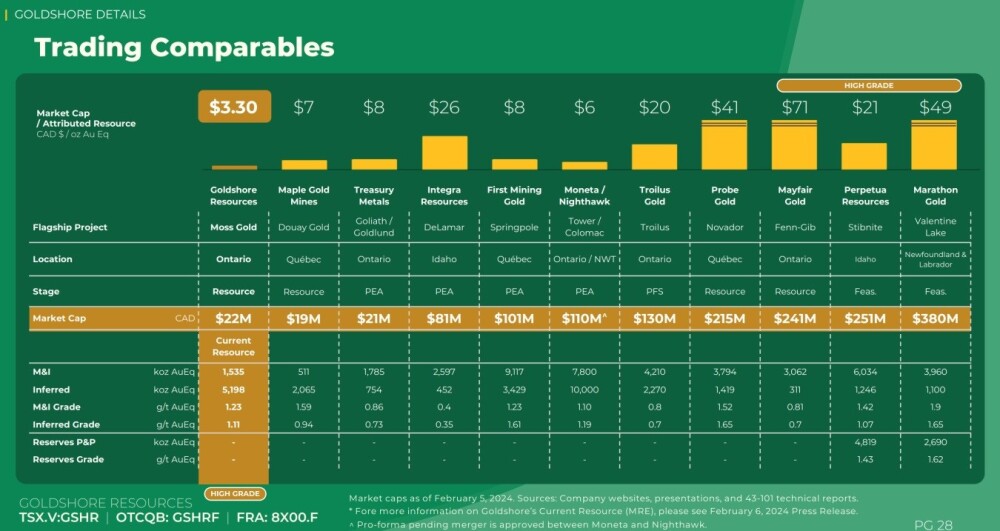

This "Trading Comparables" table makes Goldshore look exceedingly attractive when placed alongside its peers.

Similarly, the following table shows the very low value currently being placed by the market on Goldshore's mineral resources.

These tables certainly make Goldshore look very attractive indeed.

The latest 3-month chart shows the big gain since we last looked at it.

And the 4-year chart below puts recent gains into perspective, making clear that Goldshore's bullmarket is just getting started and that it has much more upside potential from here.

We stay long, and positions may be added to or new purchases made following possible near-term consolidation or minor reaction.

Goldshore Resources Inc. (TSXV: GSHR;OTCQB: GSHRF ;FWB: 8X00) was trading at CA$0.215, $0.16 at 12 noon EST on April 3, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Goldshore Resources Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldshore Resources Inc.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.