I have a lot of catching up to do after getting home last night from New Orleans. This morning, I'll start the goodies with a few quick bite-sized updates:

--> Take your nice, quick profits and SELL Sarepta Therapeutics Inc. (SRPT:NASDAQ).

Simply put, I'm less confident in the near-term prospects for further gains than I was in advising we buy this anew when it gapped down, ultimately, to the mid-50s at last Tuesday's open.

Further, good Q3 news and such out last week (see NEWS HERE) added only modestly to the oversold bounce (though we'll probably get a bonus boost early this morning, as reports of insider purchases last week will see SRPT gap up some at the open.)

With my view that the broad market's rally of the last half of last week is a BIG dead cat bounce, SRPT shares won't get any upward bias from an ongoing bullish move, IMO, either. So we'll take the money and run.

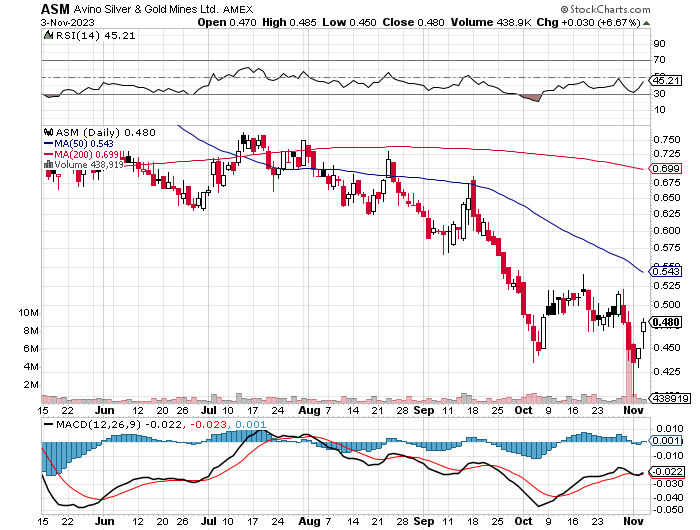

--> Next, Avino Silver & Gold Mines Ltd. (ASM:TSX.V; ASM:NYSE.MKT; GV6:FSE) REMAINS a BUY.

A few asked me about the OCT 27 NEWS that Coeur Mining Inc. (CDE:NYSE) is looking to sell the 14 million shares of Avino it presently owns.

I, in turn, asked C.E.O. David Wolfin when I saw him late last week amid a broader update on the company.

In short, according to Wolfin, Coeur has had to sink a lot of money into its Rochester (Nevada) expansion and elsewhere and is simply raising cash as it can.

Crazy, but no crazier than when it paid well over $300 million back for Penasquito before it sold that project to Avino for pennies on the dollar later.

Avino has continued to do well in a punk market operationally, even as this Coeur sale news made a bad situation worse (ASM shares have been heavily shorted during this time for weak PM stocks' prices, too.) But this is especially an instance where a broken share price does not properly reflect a company that not only is NOT broken but has scored some great exploration news in 2023, among other things.

You would do well to be buying/buying more at these levels and wait to be properly rewarded as the company's own good performance is augmented down the road by better metals prices/sentiment.

--> SELL Latitude Uranium Inc. (LURAF:OTCMKTS;LUR:CA). In visiting with other colleagues in New Orleans over the last several days, my downbeat views here were reinforced on this company/management.

And by and large, this past summer's much-ballyhooed exploration at Angilak, at least, was worse than underwhelming. And with this management's apparent focus being on other companies/projects to the point where they have been wholly unresponsive for a while now where Latitude goes, we'll move on.

Even where the white-hot uranium story goes, there's a reason why the explorers lowest on the food chain have not yet benefitted from the euphoria. It will be many years before their resources — even if proven viable — will be exploited.

(NOTE: But one significant exception to that remains Blue Sky Uranium Corp. (BSK:TSX.V; BKUCF:OTC; MAL2:FSE), which you'll be getting a bigger update on shortly and which remains a BUY also.

There, the story, in part, is that the company already has one key customer ready and waiting for its uranium and won't be toward the back of the line in global markets!)

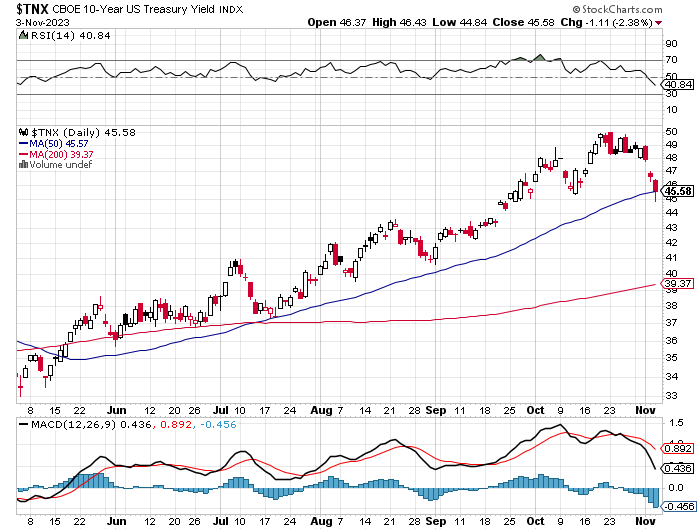

Hindsight being 20/20 (where IS that damn DeLorean when I need it?), traders would have done well to trim some inverse ETF positions when I sounded caution / Accumulate on them several days back. But that said, I do NOT believe that last week's rips higher for most stocks constitute a trend reversal.

The net result of all the recent gyrations in long-term market interest rates in both directions is that we remain in an uptrend for rates. Indeed, the yield on the bellwether 10-year Treasury is ticking back higher this morning, showing no desire to break below its 50 dma.

As soon as they are posted, I will be sharing with you two very comprehensive market commentaries from the N.O.I.C.; immediately on social media and when it's next convenient via an email. For now, consider all the inverse ETFs a "BUY" once more at their present levels.

Lastly . . . Two new recommendations for today --->

I'll have much more to say on both of these in the days not far ahead, but for now, I want to give you the names of two companies whose stories/managements have been known to me for many years and where I now see stories too compelling to pass up even with my tightened criteria for junior resource stocks as recently articulated:

First, add Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) as a BUY amid my roster of growth-oriented companies.

A few of you remember that Dolly Varden was actually a recommendation of mine many moons ago, under much different (and, in the end, sub-par) management.

The new management of the recent past, led by the dynamic C.E.O. Shawn Khunkhun, has been steadily growing Dolly Varden into one of the elite high-grade silver and gold resources in North America.

NEWS is out over yet another step-out hole in its massive drilling program to, in the end, reveal just how massive its Kitsault Valley Project/area is in B.C.'s Golden Triangle area.

Among today's releases is a hole returning 461 grams/ton of silver equivalent — 296 g of silver, 1.68% lead, and 3.01% zinc) over 26.99 meters.

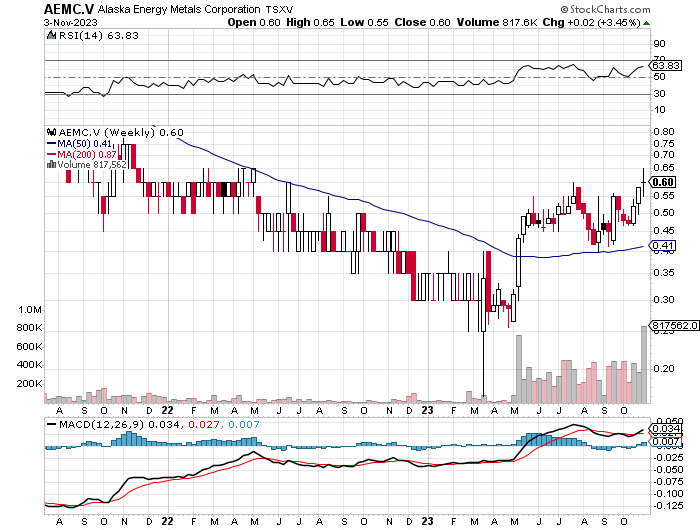

Alaska Energy Metals Corp. (AEMC:TSXV;AKEMF:OTCQB)

A decidedly better chart than has been experienced by the average resource explorer, DV's still shows the share price down by about a third from its earlier 2023 high. This is as follows: 1. the news has just kept getting better, on the way to a substantial resource upgrade I think is coming before too long, and 2. Hecla has been upping its stake in DV shares.

This pullback and water-treading since midyear, I.M.O. is a gift, allowing us a better entry point.

I'll have much more color on Dolly Varden and why I put it right up there with other high-grade stories like Amex Exploration shortly, as — among other things — I distill the notes from my visit with KhunKhun from this past weekend. For now, visit Dolly Varden RIGHT HERE.

Secondly, add Alaska Energy Metals Corp. (AEMC:TSXV;AKEMF:OTCQB) as an immediate BUY as well, among my roster of speculative opportunities.

Ultimately, the CA$22 million market cap may end up a pimple on a flea in comparison to the potential value of this emerging major multi-billion pound nickel resource in southern Alaska.

I wish I had gotten us all in earlier, but this is an evolving story still which — though additional funding will be needed going into 2024 to keep the ball rolling, as I'll be detailing further soon — CLEARLY has been garnering attention.

Here, too, I have known President/C.E.O. Greg Beischer for many years. Formerly, he ran the old Millrock Resources, a prospect generator. Yet a fortuitous set of events opened back up for him a vast area of nickel mineralization known as the Nikolai Project in southeastern Alaska.

Having known of its potential since doing some work on it way back in the 1990's for Inco, Beischer decided to focus just on Nikolai and renamed/rebranded Millrock accordingly to focus on this one premier asset.

Here again, I'll have much more color on this exciting project to follow, one which — I must add here — is adjacent to another area owned, in part by Bill Gates and Jeff Bezos, as these folks also are looking for BIG nickel projects to feed the E.V. industry (and more) of the future.

For now, visit Alaska Energy Metals RIGHT HERE.

This very comprehensive e-mail covering myriad subjects/companies was specially made available to Streetwise Reports by Chris Temple / The National Investor to demonstrate the depth and variety of information and recommendations Chris' audience receives like this several times per month. As you know, Chris is a regular contributor to Streetwise Reports.

We wanted to share his email alert (sent to his paid Members) of November 6 with you, and we encourage you to contact Chris for other similar work/research he makes available. Simply write to him at chris@nationalinvestor.com.

Want to be the first to know about interesting Uranium, Gold, Silver and Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Dolly Varden Silver Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Alaska Energy Metals and Dolly Varden Silver Corp.

- Chris Temple: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Chris Temple Disclosures:

The National Investor is published and is e-mailed to subscribers from chris@nationalinvestor.com. The Editor/Publisher, Christopher L. Temple may be personally addressed at this address, or at our physical address, which is: National Investor Publishing, P.O. Box 1257, Saint Augustine, FL 32085. The Internet web site can be accessed at https://nationalinvestor.com/. Subscription Rates: $275 for 1 year, $475 for two years for "full service" membership (twice-monthly newsletter, Special Reports and between-issues e-mail alerts and commentaries.) Trial Rate: $75 for a one-time, 3-month full-service trial. Current sample may be obtained upon request (for first-time inquirers ONLY.) The information contained herein is conscientiously compiled and is correct and accurate to the best of the Editor’s knowledge. Commentary, opinion, suggestions and recommendations are of a general nature that are collectively deemed to be of potential interest and value to readers/investors. Opinions that are expressed herein are subject to change without notice, though our best efforts will be made to convey such changed opinions to then-current paid subscribers. We take due care to properly represent and to transcribe accurately any quotes, attributions or comments of others. No opinions or recommendations can be guaranteed. The Editor may have positions in some securities discussed. Subscribers are encouraged to investigate any situation or recommendation further before investing. The Editor receives no undisclosed kickbacks, fees, commissions, gratuities, honoraria or other emoluments from any companies, brokers or vendors discussed herein in exchange for his recommendation of them.

All rights reserved. Copying or redistributing this proprietary information by any means without prior written permission is prohibited. No Offers being made to sell securities: within the above context, we, in part, make suggestions to readers/investors regarding markets, sectors, stocks and other financial investments. These are to be deemed informational in purpose. None of the content of this newsletter is to be considered as an offer to sell or a solicitation of an offer to buy any security. Readers/investors should be aware that the securities, investments and/or strategies mentioned herein, if any, contain varying degrees of risk for loss of principal. Investors are advised to seek the counsel of a competent financial adviser or other professional for utilizing these or any other investment strategies or purchasing or selling any securities mentioned.

Chris Temple is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

Notice regarding forward-looking statements: certain statements and commentary in this publication may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 or other applicable laws in the U.S. or Canada. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of a particular company or industry to be materially different from what may be suggested herein. We caution readers/investors that any forward-looking statements made herein are not guarantees of any future performance, and that actual results may differ materially from those in forward-looking statements made herein.

Copyright issues or unintentional/inadvertent infringement: In compiling information for this publication the Editor regularly uses, quotes or mentions research, graphics content or other material of others, whether supplied directly or indirectly. Additionally he makes use of the vast amount of such information available on the Internet or in the public domain. Proper care is exercised to not improperly use information protected by copyright, to use information without prior permission, to use information or work intended for a specific audience or to use others' information or work of a proprietary nature that was not intended to be already publicly disseminated. If you believe that your work has been used or copied in such a manner as to represent a copyright infringement, please notify the Editor at the contact information above so that the situation can be promptly addressed and resolved.